Subscribe to our free @AuManufacturing newsletter here.

Smaller manufacturers and the big challenge of digitalisation

It’s been said that Australia’s population of enterprises has a “missing middle.”

Within manufacturing, there is certainly a heavy weighting towards the smaller end of town. A count published in the Australian Industry Group’s Australian Manufacturing in 2019 report found that of 47,530 employing companies, 87 per cent were between 1 and 19 employees (small), seven per cent were medium-sized (20 – 199), and one per cent large (200-plus.)

Positively, manufacturing CEOs surveyed by the Ai Group have reported increased spending on technology, training and capital investment since “at least 2016.” However, there’s evidence elsewhere that investment tends to be heavily concentrated: “5% of firms drive 94% of the sector’s entire capital spending and 54% of its entire R&D spending,” according to a study published in 2017 by the Advanced Manufacturing Growth Centre.

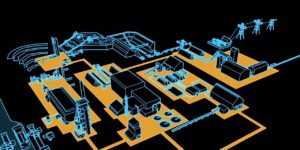

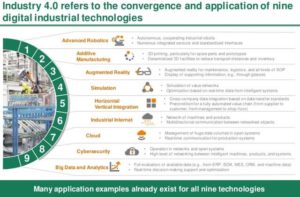

It has also been said that every single company is entering the fourth industrial revolution (or Industry 4.0). Australian SMEs (a group with a heavy emphasis on the S) face a particular set of challenges in this trend of planning, investing and improving through increased digitalisation.

One forward-thinking business, LA Services (formerly L&A Pressure Welding) has mapped out its journey, looked well outside its business, partnered with universities, government and non-government industry groups, and accepted all the challenges that come with these.

Picture: ABB/Youtube

The company of about 30 welds and fabricates structures including heat exchangers, pressure vessels, and pipes, has digitised its supply chain and processes, and is working with University of Technology Sydney’s engineering and IT faculty on the “data streams, digital interoperability and AI systems that will bring our heritage into the 21st century.”

LA’s General Manager David Fox agrees that yes, the high proportion of smaller-sized manufacturers presents special difficulties for the advancement of Australian manufacturing.

“The cost of innovation in digital can be high, be it in terms of licences, subscriptions, infrastructure upgrade (fibre into the building) or resources with the capability to take technology (Power BI [an analytics service]),” he tells @AuManufacturing.

It can also be tricky to identify meaningful applications for digital technologies, “and how they might integrate and if so, what is the impact this has on other systems, skills, business platform software, processes etc.”

Emeritus Professor Roy Green, Special Advisor and Chair for UTS Innovation Council – and who will chair the Advanced Robotics for Manufacturing Hub (ARM) when it launches in February – believes that SMEs are the engines that will drive the success of Australian manufacturing in global markets and value chains.

“While SMEs need to be at the cutting edge of technology to compete, Australia’s innovation infrastructure works more comfortably in partnership with large companies,” Green tells @AuManufacturing.

“Typically, SMEs’ innovation needs relate to their immediate commercial needs and are time sensitive. So, first we need to think seriously about how support high value R&D knowledge transfer in this environment. We also need to collaborate better to compete globally.”

One explanation of “Industry 4”

(Source: Boston Consulting Group)

Autonomous robotics have been described as one of the “nine pillars” of the fourth industrial era. Based on 2017 figures from the International Federation of Robotics, Australia is well behind advanced economies such as Germany and South Korea in industrial robotics adoption.

Value first, then technology

Accountancy firm BDO Australia released an Industry 4.0 guide last month, asserting that middle-market manufacturers (based on the ATO definition of revenues between $10 million and $250 million) are “in the best position” to benefit from the trend. Ryan Pollett, BDO’s national lead for manufacturing, says such firms are able to adapt without the inertia and red tape a larger company experiences, but are better-placed than a startup to fund their innovations.

Pollett says he’s seen clients with a variety of approaches and adoption levels, though won’t offer a comment on whether he views the large number of smaller manufacturers versus medium-sized ones as a particular disadvantage.

“There are very large companies with fairly unsophisticated maturity models at the moment in terms of they’ve done things a certain way for a long time, and if that sort of worked for them up to a point, they’ll probably not look to change that,” he tells @AuManufacturing.

“[That goes] all the way to smaller organisations, [which] sometimes have quite advanced ecosystems in place, particularly the ones that are looking to do things in high-tech manufacturing.”

The Australian Middle Market Manufacturers Guide To Industry 4.0 looks at six different dimensions of maturity, recommends small pilot activities that can be learned from and/or scaled up, and that companies consider value creation before technology, rather than gadgets or software first.

“If you just focus on what’s the shiny new technology available, ‘let’s get that in there,’ you can very easily go off on a tangent that won’t support the business,” says Pollett, who also recommends “incrovation” (incremental innovation) and says he’s recently seen customers benefit through simple data analytics applications.

Picture: Kuka

“Sometimes it’s a small change that can have a big impact… Taking that next step to use your existing technology and your accounting system and stock recording system to get the most of the data that’s there without necessarily… adopting radical changes.”

Expertise and real-world examples

Queensland University of Technology Associate Professor Cori Stewart, Bid Developer for the ARM Hub, believes that Australian manufacturers are “reasonably well aware” of the plusses of adopting new business models and technologies. The ARM Hub – a collaboration between UAP (Urban Art Projects) and the university – aims to increase the adoption of robotics and design-led thinking by SMEs.

“They know early adopters can reap the benefits of defining their place in an increasingly global and digital marketplace, where those who don’t digitally transform, or wait too long, risk shrinking their market and becoming irrelevant,” she tells us.

“The barrier we find for businesses is getting access to the expertise and real-world examples needed to learn about as well as test and implement new technologies.”

There are other challenges for small and medium-sized manufacturers in adopting new digital solutions, even after they’ve accepted that transformation and maintaining relevance are inseparable.

Picture: LA Services

Fox says that a recent, king-sized challenge is juggling innovation and business as usual. If anyone can relate to this, an SME can.

“Particularly when you have committed to an R&D project that has partners relying on you to project manage it and deliver information, and all of sudden the R&D needs an internal resource with the knowledge to connect the research to the business systems and processes. This means resources for BAU (revenue work) are reduced,” he says.

“I am living this pain at present and have not found an answer yet.”

– Brent Balinski, editor @AuManufacturing

Featured picture: www.freepik.com

@aumanufacturing Sections

Analysis and Commentary Awards Defence Manufacturing News Podcast Technology Videos