Australia’s place in the semiconductor world: repositioning Australia’s chip industry

Today's edition of Australia’s place in the semiconductor world takes a look at the growing importance of compound semiconductors. Stef Winwood argues that if Australia invests strategically, with a view to the future, it could carve out a logical niche and realise compound returns

The global semiconductor industry is currently a $US 600 billion a year opportunity. As the world accelerates its transition to electrification and digitisation, the industry is set to grow to more than $US 1 trillion a year by the end of the decade1. Despite their critical importance to almost every industry, semiconductors are one of the least understood technologies and sectors in Australia.

But what are semiconductors and why should you care?

Even if the term semiconductor is unfamiliar, they are endemic to everyday life, and undoubtedly you have interacted with a multitude of semiconductors already today.

Semiconductors, also known as microchips, are the single most important technology that underpin all leading-edge industries. They’re essential for both the manufacture and proper functioning of everything from smartphones, fridges, and hairdryers to electric vehicles, advanced medical equipment, supercomputers, wireless communications, and defence applications; semiconductors are a ubiquitous technology. Semiconductors support our terrestrial lives as well as marine, submarine, and aerial applications, and have been fundamental to powering our explorations further into the galaxy since the first Apollo mission.

Beyond the obvious economic and business opportunities, semiconductors are also important to Australia’s future national security and sovereignty. In a recent report, the Australian Strategic Policy Institute (ASPI) said, “Having unfettered access to microchips is a matter of economic and national security, and, more generally, of Australia’s day-to-day wellbeing as a nation. In an increasingly digitised world, policymakers must treat semiconductors as a vital public good, almost on par with other necessities such as food and water supplies and reliable electricity.”

Understanding that in today’s digitalised world, our national wellbeing and security is dependent on access to advanced semiconductor technologies, it is time for Australia to take a serious look at our place in the semiconductor world.

Historically, Australia has had limited participation in the global semiconductor ecosystem with only a handful of highly innovative semiconductor players developing novel technologies and playing important niche roles. Australia’s nascent local industry places the nation at a significant geopolitical disadvantage, particularly given the backdrop of increased techno-nationalism, prospective global insecurity and instability, and a complex global economy which is heavily entwined. This makes it imperative that we quickly move to shore-up our national semiconductor security, build our domestic capability and capacity, not least because we are starting on the back foot.

Gallium Nitride represents an enormous opportunity for the Australian semiconductor industry, writes Stef Winwood.

Despite the ambitious and enormous investment a local semiconductor industry requires, it will have compound returns for the nation.

Why hasn’t Australia made advancements in this direction already?

Today, advanced microchip fabrication facilities (fabs) perform the most complex and precise manufacturing processes ever employed in human history. Involving hundreds of complex manufacturing steps including deposition, photolithography, photoresist coating to etching, metrology and ion implantation, all performed under vacuum in cleanrooms with tightly controlled air quality and temperature, and supported by advanced robotics. These enormous, advanced facilities can take years to build and cost hundreds of billions of dollars.

The leading semiconductor jurisdictions (Taiwan, South Korea, and Japan) are reaping the substantial rewards of many decades of focussed government policy and investment, which have attracted the world’s leading chip companies such as Apple, Google, Amazon, and Intel. In turn, these leading chip companies have co-invested in the development of Southeast Asia’s leading semiconductor industry.

Taiwan’s TSMC has unparalleled chip making capabilities, producing 90 per cent of the world’s advanced silicon semiconductor chips today. The strategic importance and interdependence of Taiwan and TSMC are well understood by both the US and China. According to the Congressional Research Service (CRS), the United States’ share of global semiconductor fabrication capacity has fallen from just over 40 per cent in 1990 to less than 12 per cent in 2020. Given the high costs and complexity of chip manufacturing, many US semiconductor firms transitioned to a “fabless” model, outsourcing manufacturing to Southeast Asia while maintaining the higher-value design elements for advanced and cutting-edge chips. With the changing geo-political environment, the Biden administration is taking aggressive policy action and investing heavily to re-shore capability. In China’s case, Chris Miller, author of Chip War, reports that China spends as much importing chips today as it does on importing oil2.

For Australia to carve out its own high-value semiconductor sector, the question then arises: where to invest?

If Australia invests strategically with a view to the future, it could carve out a logical niche and emerge as a technology powerhouse with many compound returns. This niche would need to enhance existing local investment, talent, and innovation, focussed on commercialisation.

Semiconductor technology can be divided into two distinct branches. The first is the silicon-based ‘traditional’ semiconductor, which currently accounts for 90 per cent of the market. While it is the largest segment and today’s technology of choice, it would be extremely costly for Australia to enter, pitting us against the well-established giants of Taiwan and Korea, on which we currently rely heavily.

Silicon became the material of choice for the semiconductor transistor and metal-oxide-semiconductor field-effect transistor (MOSFET) due to its highly advantageous electrical properties, scalability, and lower costs. Silicon-power MOSFETs are thought to be now fully mature, and as a result can no longer continue to meet the requirements of ‘Moore’s Law’, which calls for a doubling of performance with a lowering cost approximately every 18 months. This has led to the search for a replacement material which offers infinitely fast switching speed, no electrical resistance, and lower costs. Exciting new base materials for high-performance power conversion transistors and integrated circuits have emerged.

This promise lies in the second, nascent branch of the semiconductor sector, compound semiconductors.

Although compound semiconductors are even more complex to manufacture than silicon, they have three distinct advantages that outperform silicon and provide greater power, speed and light. While silicon dominates the processor and phone markets, compound semiconductors, such as Gallium Nitride, Silicon Carbide, Indium Phosphide and Gallium Arsenide, already underpin communications, sensing and photonic applications with potential to disrupt the current semiconductor ecosystem.

This alternative investment focus would look to the next generation of semiconductors, investing in retaining Australia’s deep technology development and research heritage in the compound semiconductor and quantum computing segments.

An obvious leader in this class is Gallium Nitride (GaN). Invented in the 1990s, GaN is a wide bandgap semiconductor touted to be the most important semiconductor material since silicon. It is the leading candidate for taking electronic performance to the next level and restarting the Moore’s Law phenomenon. GaN conducts electrons 1000 times more efficiently than silicon and is also cheaper to manufacture.

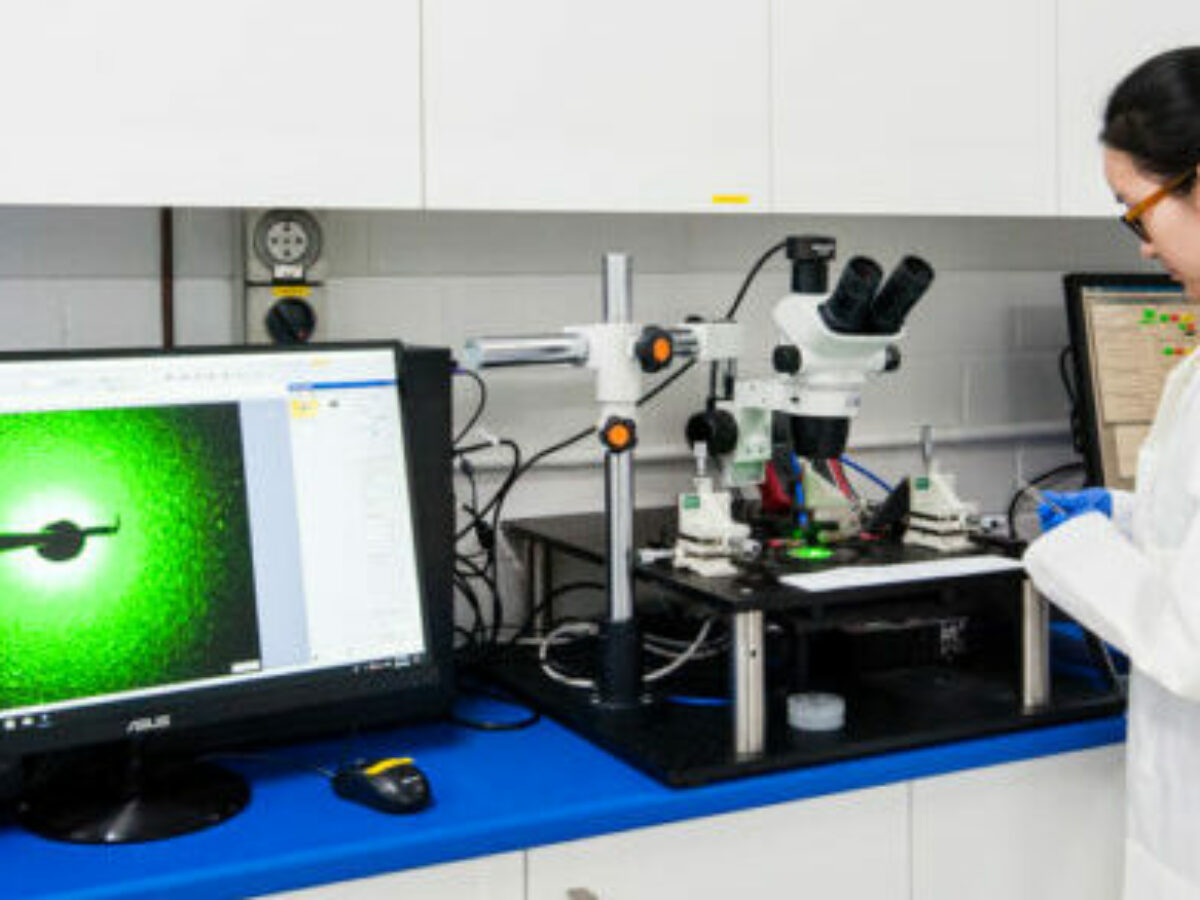

GaN represents an enormous opportunity for the Australian semiconductor industry. Investment would build on existing cutting-edge domestic capacities, including Silanna and BluGlass. Additionally, Australian innovators have developed a unique gallium nitride deposition technology (the equipment and processes that grow the compound semiconductor thin films onto the wafers), called Remote Plasma Chemical Vapour Deposition (RPCVD)3 not available anywhere else in the world, with capability to further enhance the performance advantages of GaN across many applications.

Furthermore, compound semiconductor fabs are significantly more streamlined, involving fewer processes and equipment, and cost a fraction of the build cost of their silicon counterparts to achieve improved power output and efficiency, for example in power electronics applications for electric vehicle batteries.

As these truly disruptive technologies mature and scale in the not-too-distant future, silicon technology in the semiconductor industry has the potential to be overtaken by compound semiconductors in many markets, making late-to-the-party investment in this area highly risky.

In contrast, since its invention, GaN has established a foothold and cemented its performance, into nearly every semiconductor technology sector, and has unrivalled potential to address two significant problems for Australia. First, investment and development in this area has the potential to place Australia as a forerunner in the global compound semiconductor market, ensuring our ongoing position as a global player. Second, development of this domestic capability would help facilitate Australia’s technological security and sovereignty and help ensure our continued national well-being.

Picture: Supplied

-

McKinsey https://www.mckinsey.com/industries/semiconductors/our-insights/the-semiconductor-decade-a-trillion-dollar-industry

-

Chip War: The Fight for the World's Most Critical Technology. Chris Miller

-

BluGlass’ patented RPCVD technology has performance advantages for the growth of group III nitrides such as gallium nitride and indium gallium nitride, due to its lower temperature, low hydrogen growth technology, promising higher performing devices and a cleaner lower cost method of manufacture.

Stef Winwood is Head of Corporate Affairs at Bluglass. She is a technical communications and corporate affairs executive with over 15 years’ experience in the semiconductor industry. Having held senior roles in both Fortune 500 companies to technology start-ups, Stef has helped build and establish brands and businesses from concept all the way through to IPO listing in the high-tech, semiconductor and regulatory technology sectors. Developing leading-edge semiconductor manufacturing technology and devices for more than a decade, BluGlass Limited (ASX:BLG) is a global provider to the GaN photonics industries, delivering cutting-edge, custom laser and LED development across the industrial, defence, display, and scientific markets.

@AuManufacturing![]() and AUS-Semiconductor-Community’s editorial series, Australia’s place in the semiconductor world, is brought to you with the support of ANFF.

and AUS-Semiconductor-Community’s editorial series, Australia’s place in the semiconductor world, is brought to you with the support of ANFF.

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos