Australia’s place in the semiconductor world – Software may be eating the world, but software is nothing without semiconductors

Due to an unexpected number of high-quality contributions, @AuManufacturing’s Australia’s place in the semiconductor world editorial series has been extended again. Here Mike Nicholls writes that Australia has the opportunity to build a thriving semiconductor industry without investing $20 billion to build a fab. But we do need to get started.

It’s hard to imagine, but 20 years before the establishment of TSMC in 1987 and the rise of Taiwan as a semiconductor powerhouse, Australia had numerous semiconductor fabs making TV and radio chips across the country.

CSIRO established a research fab in 1953 and AWA took this over in 1958. AWA had been building radios and instruments for decades in Australia. Philips had a semiconductor factory in Adelaide, Fairchild Semiconductor had a factory in Croydon and National Semiconductor had a factory in Bayswater, Victoria.

Standard Telephones and Cables, a UK company which eventually became part of Alcatel Australia, was making phone systems and audio transistors for Telecom (which became Telstra). Back in the day Telecom Research Laboratories employed hundreds of engineers and scientists and actually made communications products.

Picture: Philips Electrical Industries factory in Hendon, Adelaide

Prior to the 1990s, Australia probably had a similar level of semiconductor industry activity as Taiwan.

Once upon a time in the late 1990s-2000s, an Australian startup Radiata invented and built the first fast WiFi Chips from inventions stemming from research carried out by the astronomy teams in CSIRO and Macquarie University. Radiata was sold to Cisco for $570 million AUD before it had launched their chip to the market.

Credit: CSIRO and AFR

Wait, what!? Stop and think about that for a moment. An Australian startup based on CSIRO research made the first Fast WiFi chips.

Half the world’s population has never lived in a world without WiFi. Can you imagine a world without WiFi now, or that an Australia startup, spun out of research, actually helped make it happen?

Silicon Myopia

Recently I spent a few hours talking to one of the founders of Radiata and he regaled me with stories of how virtually none of the government, public service or research leaders of the day actually understood the significance of WiFi when they presented this for commercialisation. Many were openly skeptical, and, like the general public of the time, would ask why they would need a wireless internet connection; their wired network connection was fine. Very few people had the foresight to see a world with mobile computers and smartphones dominating our lives and outgrowing desktops and mini computers.

Historically, Australia has had some success in the semiconductor world, but we appear to repeatedly suffer from Silicon Myopia.

We have largely ignored the geopolitical and economic impact this industry has on technology. Almost every major technology development in the last 100 years was enabled by new semiconductor development and capability.

Computing, genetic sequencing, mobile phones and communications, healthcare, imaging and treatment, vehicles, aircraft, space, appliances, process control and manufacturing, almost anything with a power cord now has 5-1,000s of semiconductors driving it. In the quest for zero emissions, power semiconductors are one of the highest growth segments with the adoption of electric vehicles and batteries, as well as ongoing growth of solar and wind.

The global market for semiconductors is one of the biggest markets in the world at US$500 billion, but unfortunately Australian companies only earn approximately $100 million of that revenue.

Unfortunately the Australian semiconductor industry fell by the wayside in the 70s-80s during fiscal deregulation and economic pushes to focus on areas of competency (in our case minerals and food) and outsource other high tech areas to low cost countries. Those factors combined with a reduction in tariffs effectively led to the shutdown of our industry, leaving small pockets of designers and engineers working for multinational R&D offices.

With COVID-19 severely disrupting the global supply chain and increasing geopolitical tensions, our reliance on semiconductors has been brought to the forefront. Alongside energy and food, producing semiconductors has become one of the key national security issues of this decade.

People mistakenly talk about semiconductors like they are one technology and one market, but there is a lot more to this segment than meets the eye.

There are numerous different types of components and technologies that get lumped together, and different countries have different strengths in each subcategory.

There are a few ways to categorise the semiconductor space.

We talk about the technology type. Process nodes (how small the size of the features, transistors and circuits) smaller = more power efficient and lower cost. There are also different types of semiconductor materials: CMOS silicon, silicon carbide, GaS, Gan, and many other more experimental materials.

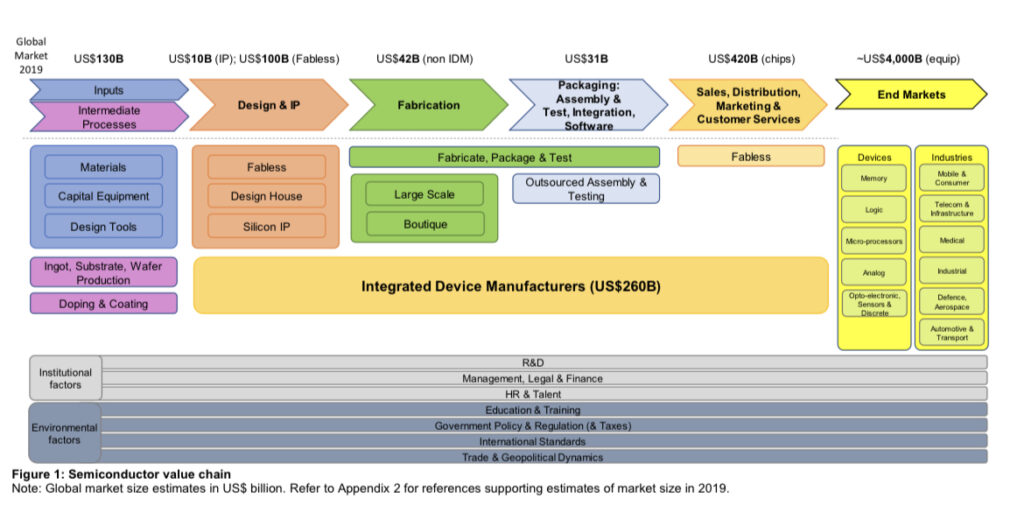

There are also numerous parts of the value chain, including raw materials, wafer production, product design and development, IP, fabrication, packaging, sales and marketing.

People talk about solving the semiconductor supply chain crisis but few people realise there are hundreds of interlocked specialist companies in numerous countries working together to deliver a finished product.

Chip designers in the US or Europe send their designs to a fab in Taiwan, Korea or the US, and these are fabricated and then sent to packaging and testing in another country again and finally sent to OEMs who assemble them into their finished products.

This is a highly complex manufacturing process, with a highly complex supply chain and interdependence. You can’t solve this overnight but you can start chipping away at the key drivers in the industry.

The majority of major chip companies started life as a startup. If you want a chip industry, you must start with startups.

An Australian semiconductor strategy

For decades semiconductors have been absent from industry development agendas and spending plans.

Australian policy makers and industry may not have deliberately ignored the space, but it’s always seemed just a little too hard and likely to take too long and be too expensive.

Discussions about the semiconductor industry in Australia are often met with denial. Australia can’t play in this space. The discussion usually starts and ends with a comment that we can’t afford $10-20 billion dollars to build a fab and we stop there, and the topic gets dismissed.

These huge numbers only apply to the very latest fabrication technology, primarily for high-powered CPUs and GPUs, but there are many other semiconductor types, such as power semiconductors (experiencing very high growth due to electric vehicles and batteries) and RF semiconductors such as WiF. 5G actually uses relatively old, lower-technology processes that are far cheaper to purchase.

Thirty years ago, Taiwan had almost no capabilities, but their government saw an opportunity and courageously invested in what was then an emerging industry. In the late-80s, the Taiwanese Government invited Dr Morris Chang to return from the US to Taiwan to launch a joint venture with Philips and created a 30 year plan that helped launch TSMC to eventually become a $60 billion revenue, $400 billion-plus market cap giant that now dominates the $US 500 billion per annum semiconductor industry.

It took Taiwan 30 years to go from basic capability to global domination. I acknowledge that this is a decadal challenge, but if we want to achieve national technology sovereignty we must prioritise investment in the semiconductor sector.

Semiconductors were not included as a priority in the Modern Manufacturing Initiative (MMI) grant program. Likewise, while mentioned, they have not been prioritised as a standalone category in the Critical Technologies List or the National Reconstruction Fund. This may discourage startups from spending the time to apply if they don't fit the guidelines.

Quantum Computing is attracting large amounts of funding and interest, although it is widely believed that we will not see useful quantum computing widely deployed for decades. There is a very high probability that silicon CMOS processors will remain the dominant computing platform for at least the next 30-50 years and the markets for these products will continue to grow and evolve.

What are other advanced nations doing?

In 2014, China made semiconductor independence one of their national priorities and has since directed over $70 billion into almost 3,000 companies. From data sourced on Pitchbook, about 90 per cent of the investments into startups in the last two years have been made by Chinese investors into Chinese startups.

The US government has recently approved more than $US 50 billion to build out new high tech fabs.

India just launched a $20 billion fund to invest in semiconductor fabrication facilities, with the government investing $10 billion to attract an additional $10 billion from fabs. They’re also allocating $2 billion to help get hundreds of semiconductor startups off the ground.

Japan is installing an $800 million fab. Canada has also just launched a $1 billion initiative to bolster manufacturing and research.

Taiwan and Korea continue to invest tens of billions of dollars in R&D and new fabs.

Asia continues to be one of the world’s largest markets for semiconductor manufacturing with Singapore serving as home to more than 50 semiconductor and fabrication facilities.

Europe has announced a €43 billion investment program in the semiconductor sector.

Semiconductor Investment in Australia

Semiconductors have traditionally been a specialised investment field, with a handful of investors in each country specialising in it. Most traditional VCs don’t understand the segment and until recently have avoided it, but we are seeing more interest and investments globally from mainstream VCs.

After decades of little activity, Australia now has well-funded semiconductor design companies designing and testing here. WiFi chip design startup Morse Micro (now in production) and a 5G Chip startup Millibeam (still developing) are both launching Radio Frequency chips into huge global markets.

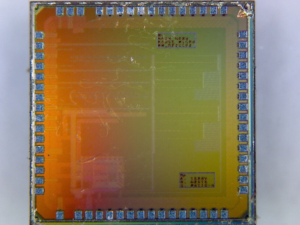

Image One of the first test chip designs for Morse Micro from 2017

Our fund, Main Sequence, seed funded both these startups prior to their first test chips. It took five years of work and support from more than eight Australian venture capital funds as well as US Semiconductor veteran Ray Stata to get the Morse Micro long range WiFi chip to production.

Recently, Morse Micro shipped their first production chips and announced $170m in funding from Tokyo listed Semiconductor company Megachips, as well as a raft of Australian Super Funds.

Millibeam has completed their first test chip tape outs and is testing their new chip over the Christmas break with production expected in 2024.

It takes patient capital and significant support to launch an industry. Neither of these startups would have progressed without grant support in the early days from federal and state governments and venture capital investors with long time horizons.

Where can Australia compete?

Australia has a very strong history in RF development largely due to our involvement in supporting US space launches and CSIRO astronomy research.

We also have a strong research capability in renewable energy and power semiconductors, silicon photonics (the blending of electronics and photonics for next generation chips), compound semiconductors (materials with different physical composition that makes them far more suitable for jobs that require high power efficiency).

Fabrication is really an infrastructure play requiring huge capital investment. only available to the very largest companies or nation states, and not really a place VC investors can meaningfully invest. Typical fab capital costs exceed $1-20b depending on the type of technology being developed.

The headline $10-20 billion, which is typically bandied around, really only applies to the very latest fabrication technology, primarily for high-powered CPUs and GPUs. But there are many other types of components and technologies that are far less expensive and provide high growth opportunities, such as power semiconductors and radio frequency (RF) semiconductors.

It is encouraging to see the NSW government, led by the Chief Scientist, launching a packaging facility, as this is an area where we can potentially gain a foothold.

As a nation, we need to think about the return on investment in the long-term, and better recognise the strategic importance of fostering a semiconductor industry here in Australia to build a more shock-resistant economy.

In my opinion there are opportunities in investing in research fabs for new types of fabrication methods or materials or segments such as power semiconductors which are experiencing extreme growth due to the electrification of vehicles and renewable energy.

Semiconductor startup ambitions?

Australia should have ambitions to be a global player in the semiconductor industry. I am not advocating spending billions on a new fab, but we can take the first steps by helping make Australia the best place in the world to launch a semiconductor startup.

Semiconductor startups are typically fabless chip designers, designing, engineering and selling chips for particular markets. The design, IP and sales part of the industry value chain is worth ~$500 billion per annum.

Some of the world’s most valuable semiconductor companies do not own or run their own fabs. Nvidia, AMD, Qualcomm, and Broadcom are all fabless Semiconductor companies with +$10 billion market caps.

Semiconductor design companies are typically much cheaper to launch than fabs. It’s common to get semiconductor startups to market for $50-100 million vs $1-20 billion for a fab. For the price of a low-end fab we can launch 50 design startups, but we have to address a barrier to entry for startups.

Credit: Office of the NSW Chief Scientist

Breaking through the Silicon Wall

Semiconductor startups face a Silicon Wall that no normal startup faces. The costs of launching a semi startup mean that it can't be done without venture capital or government funding.

Each chip startup needs the following

- Electronic Design Software (EDA) to create the chip design, which typically costs $20-50k per designer per year. With a team of five to ten designers it’s pretty easy to get $500k pa in software costs.

- Tape outs (making the first test chips) cost between $50-250k per tape out and we will typically need three to ten tape outs before we go to production.

- Production mask, which can cost hundreds of thousands to millions depending on the process node.

- Two to five years of funding for the team before the company wins orders and starts to make revenue.

So how do we make Australia the best place in the world to launch a chip startup?

If we can fund the first few years of tape out costs, software licensing, production masks and facilitate visas, we can attract the world's future semiconductor entrepreneurs to launch their companies here in Australia.

50 semi startups – first steps to a semiconductor industry in Australia

The one question we have to ask ourselves is, if we look forward to 2030, will Australia have a blossoming semiconductor industry with dozens of semiconductor companies or will it be a wasteland of missed opportunities?

If we want to launch 50 startups here we will need a better understanding and recognition of the sector, financial support for research and early stage companies, education and skill development and targeted skilled migration.

Main picture: Credit radiomuseum.org

References

https://www.nma.gov.au/defining-moments/resources/wi-fi

https://www.atnf.csiro.au/research/conferences/2016/IDRA16/presentations/O_Sulliva nJohn.pdf

https://www.radiomuseum.org/dsp_hersteller_detail.cfm?company_id=7394

https://www.researchgate.net/publication/286455655_Creating_and_Exploiting_Intangi ble_Networks_How_Radiata_was_able_to_improve_its_odds_of_success_in_the_risky_ process_of_innovating

https://en.wikipedia.org/wiki/Telstra_Research_Laboratories

Mike Nicholls is a partner at Main Sequence, a seed investor in Morse Micro and Millibeam, and Co-founder of AUS Semiconductor Community. Mike Nicholls is the most active semiconductor investor in Australia and helps organise events for the Australian semiconductor community. Main Sequence is Australia’s premier deep tech investor with $570m under management, investing in AI, photonics, quantum, synthetic biology, robotics and drones, medtech and space startups with Australian research connections.

@AuManufacturing![]() and AUS-Semiconductor-Community’s editorial series, Australia’s place in the semiconductor world, is brought to you with the support of ANFF.

and AUS-Semiconductor-Community’s editorial series, Australia’s place in the semiconductor world, is brought to you with the support of ANFF.

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos