@AuManufacturing![]() and AUS-Semiconductor-Community’s editorial series, Australia’s place in the semiconductor world, is brought to you with the support of ANFF.

and AUS-Semiconductor-Community’s editorial series, Australia’s place in the semiconductor world, is brought to you with the support of ANFF.

Australia’s place in the semiconductor world — tech wars and factory floors

Beginning week three of Australia’s place in the semiconductor world, Sercan Altun considers the role of chips in enabling a nation's self-sufficiency goals in manufacturing, and the implications for Australia.

The seeds of the current “Cold War 2.0” discussions were laid due to a rising China on the global stage, with massive economic and military projects challenging the West, in particular America, which has enjoyed unilateral superpower status since the demise of the Soviet Union.

Another challenge the West has faced is a military conflict in Europe not seen since the 1940s, resurrecting Cold War 1.0 concerns about possible nuclear conflict and fears similar to the Cuban Missile Crisis that dominated world affairs back in 1962.

In the 21st century, another possible Cold War with another upcoming superpower involves a different set of challenges compared to the first one.

This time China poses huge challenges on many different fronts. One of the ideas emerging across the world due to the supply chain issues of the pandemic is the need for self-reliance.

Among shortages of many items, however, semiconductors stand out for their particularly significant strategic as well as economic and technological role. One of many notable examples is the announcements made by the Chinese leader Xi Jinping on plans to reduce dependence on foreign chips with a total import value of $400 billion, with China making huge investments to develop an indigenous chip industry as they seek to consolidate their superpower status.

Why is the tech war focussing on semiconductors?

To answer that question, we need to recap what has gone on since the beginning of the pandemic.

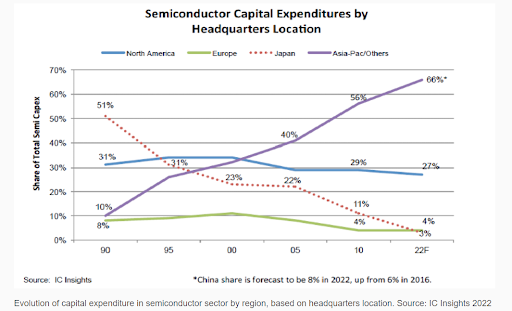

Shortages of semiconductors have affected 169 industries, with major producers unable to keep up with demand due to semiconductor production mainly being focussed in South Korea and Taiwan, with the latter accounting for 60 per cent of all the world's microchips and 90 per cent of its most advanced chips.

Having said that, the use of these chips in electronics makes them particularly special. They play a significant role in national capabilities in advanced manufacturing, defence and aerospace, machine learning, artificial intelligence, cybersecurity, 5G communications, supercomputing, biological, chemical, food and water security, and just about any other area regarded as vital to the national interest.

Another major battle has been on the advanced manufacturing front, to have the world-class manufacturing capabilities needed for economic sovereignty.

A powerful indigenous semiconductor industry helps both nations make their transition from conventional manufacturing to advanced manufacturing smoother. The use of data has been paramount in informed and educated decisions, given the increasing data volume from sensors: the eyes and ears of the modern factory, the actuators that act as its arms, and control systems, which have also undergone huge advancements in the ways data is collected and processed.

On the plant floor, this is manifested by increasing process and event data volumes that have been enabled by IO-Link communications, integrated into all the aforementioned elements, with diagnostics also helping manufacturers with preventative measures to ensure high plant availability by minimising downtime.

Semiconductors are the backbone in all this data collection and processing. Advanced semiconductors incorporated into manufacturing practices can open up further opportunities.

Enormous data volumes collected from factory floors and industrial complexes and stored either on-premise or in the cloud should also be processed in real-time rapidly and efficiently, with different computing and machine learning practices coming into play.

Given cybersecurity threats felt all across industries, edge computing has been gaining popularity versus cloud computing, keeping data away from prying eyes. Another benefit of edge computing is superiority with latency times. Processing data and identifying potential risks quicker requires chip-powered solutions, with artificial intelligence working in tandem with deep and shallow machine learning techniques.

On the cloud computing front, huge competition between the big three companies – Amazon (AWS), Microsoft (Azure) and Google (GCP) – has seen each attempt to increase profit margins by buying up chip companies.

Amazon has increased its market share thanks to the acquisition of the Israeli chip start-up company Annapurna Labs – designing their Graviton chips used in their servers through a partnership with Taiwan Semiconductor Manufacturing Company – back in 2015.

Google and Microsoft have been trying to follow suit, on the hunt for other chip companies to reduce the cost of hardware. By enhancing their in-house chip design capabilities, these cloud vendors have been looking for more marginal gains to be invested in this burgeoning industry to increase market share.

Another recent benefit offered to manufacturers from cloud service providers is cloud services brought to the factory floor for the time-critical operations and processing with machine learning tools.

Given services such as data processing, analysis, and storage brought close to the clients’ endpoints, enabling manufacturers to deploy APIs and tools to locations outside cloud provider data centres, can mitigate worries about critical data being stored in the cloud.

Within all advanced manufacturing processes from collecting data to processing, a robust and sound semiconductor industry reduces reliance on the foreign countries leading in this space.

Where does Australia fit into the picture?

In the ongoing tech war and the possibility of Cold War 2.0, Australia has found itself in an interesting position with China, its largest trading partner, and the USA, a close ally and the major security partner.

Throughout the changes both of these nations are vying to master, Australia should take a page out of Taiwan’s playbook, thinking ahead with emerging technologies in mind rather than keep the current trajectory of just digging and shipping raw materials without value adding.

Throughout the changes both of these nations are vying to master, Australia should take a page out of Taiwan’s playbook, thinking ahead with emerging technologies in mind rather than keep the current trajectory of just digging and shipping raw materials without value adding.

Taiwan achieving world leader status in the semiconductor industry is definitely not by chance, but the result of massive government support and long-term planning.

The whole industry is forecast to hit $1 trillion by 2030. The USA with its CHIPs and Science Act is planning to invest $280 billion, the EU with its European Chip Acts has earmarked more than €43 billion euros in public and private investments, and China is planning to invest effort and capital amounting $150 billion to gain market share. All these efforts are to shore up their influence and economic, diplomatic and military power with a sound semiconductor industry.

Given Australia’s middle power status in this competition, with a highly skilled workforce and rich and unmatched natural resources, a change in our understanding is required.

In the current digital transformation journey, our manufacturers have been doing their bit to try to decarbonise their economic footprints, transitioning to cleaner, cheaper and more reliable energy, and adopting the digital technologies required by extremely dynamic supply chains.

To complete the picture, it is incumbent upon all of us, from federal and state governments to industry and union bodies, to work on this mission to further strengthen Australia’s sovereign manufacturing capabilities and increase our self-sufficiency in manufacturing. This includes espousing the unprecedented changes in the semiconductor industry amid international trade and tech rivalry.

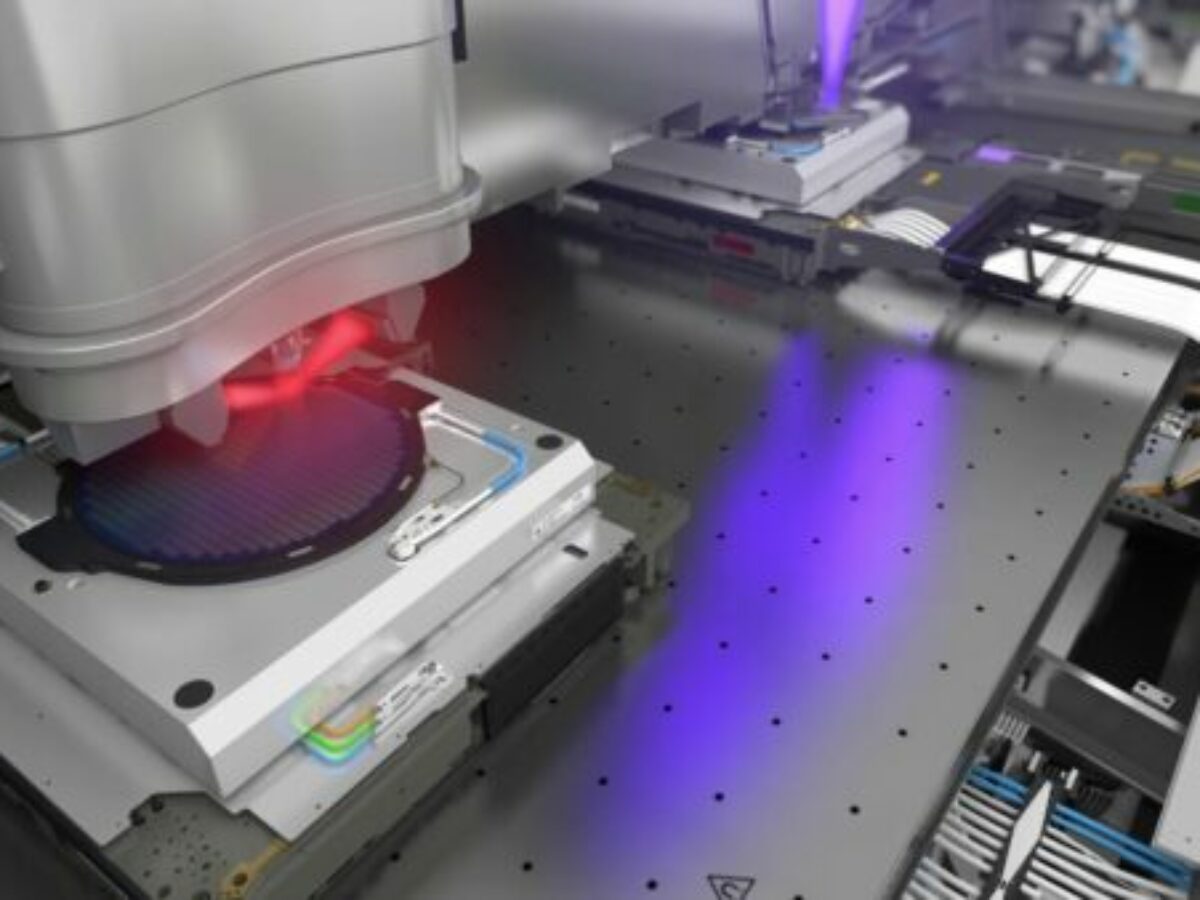

Picture credit: ASML/Youtube

Sercan Altun is an electronics engineer and technical sales engineer at Pepperl+Fuchs (Australia) with extensive knowledge in the field of digitisation of production systems, the industrial internet of things (IIoT) and advanced manufacturing processes. Pepperl+Fuchs is a company specialising in factory and process automation.

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos