DroneShield continues to lose investor support

Shares in drone detection and countermeasure company DroneShield have continued their downward slide despite the release of the company's latest quarterly report to shareholders.

The company's shares have been under pressure since earlier this month when a negative media report questioned the valuation of the company, which has been riding high on rapid growth and sentiment surrounding the war in Ukraine.

Yesterday the company's shares closed on the ASX at $1.42 valuing the company at $1.18 billion.

However this is down from a high this year of $2.72 only a week ago.

The quarterly report failed to halt the slide.

Observers noted that while the company continued its rapid growth in the first half of the year, achieving record revenue of $24.1 million in the half, growth was slowing.

While first quarter revenue was $16.7 million, second quarter revenue was $7.4 million.

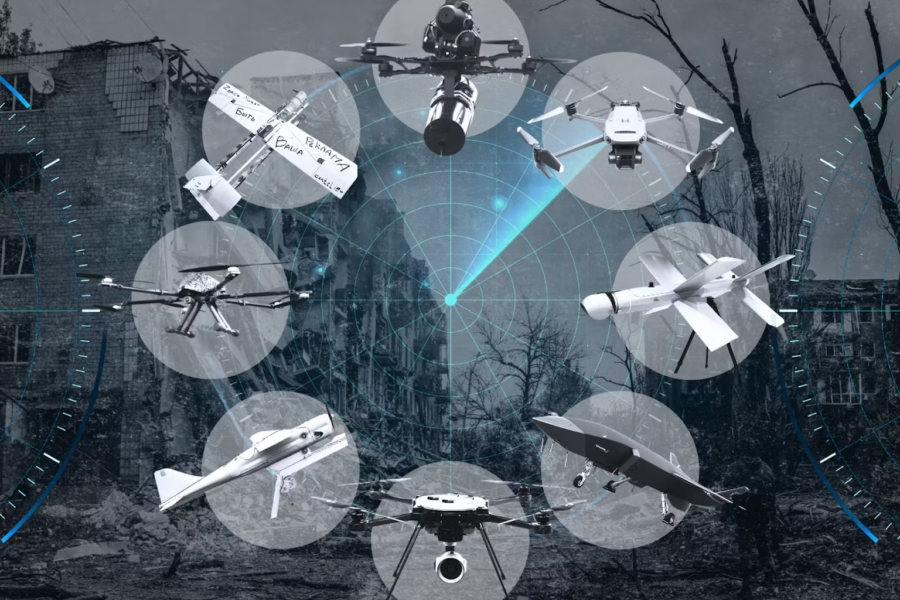

DroneShield has found itself in a unique position, giving investors access to the hottest defence technology story of recent times – the rise of drone and counterdrone warfare.

The company's systems have been in hot demand, including being utilised in Ukraine.

However the drone and counterdrone game is constantly changing, with Ukraine and Russia countering new technologies with their own, forcing further technological innovation.

So far DroneShield has kept ahead of the game, and was able in its report to point to a doubling increase in its order pipeline since 31 March 2024 to $1.1 billion1.

The company noted: “:Significant ramp up in the Asia region (especially countries neighboring China), as multiple Governments are commencing substantial C-UAS programs against the threat of small Chinese drones conducting surveillance of sensitive areas, harassment and potential .”

Investor sentiment however remains positive for the company in the medium and long term.

One broker commented that the company enjoyed operating leverage in the business, driven by high gross margins above 70 percent and a relatively fixed cost base.

This would see significant bottom line earnings growth on any upside to current revenue forecasts.

Picture: DroneShield

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos