Energy transition investment passes one trillion

Investment in a transition in the energy market to low-carbon alternatives has passed $1,000 billion for the first time, according to new figures from BloombergNEF.

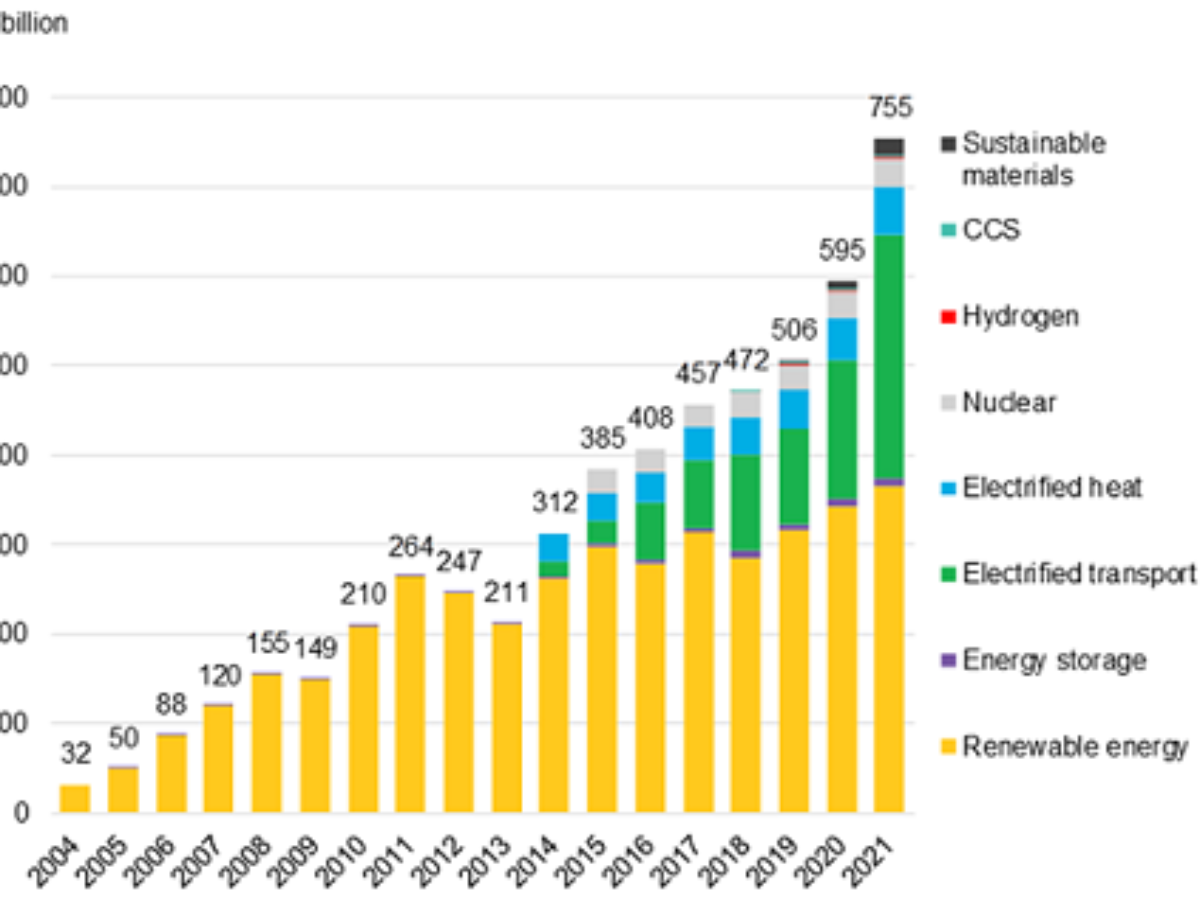

Their Energy Transition Investment Trends 2022 report found that global investment in renewable energy, energy storage, electrified transport, electrified heat, nuclear, hydrogen and sustainable materials hit $1.1 trillion (US$755 billion) in 2021.

The new record includes wind, solar and other renewable sources of electricity which are the main areas of investment in Australia and globally, rising 6.5 per cent in a year.

China is the biggest spending country for energy transition investment, committing $380.6 billion in the year (US$266 billion).

BNEF analyst Albert Cheung said: “The global commodities crunch has created new challenges for the clean energy sector, raising input costs for key technologies like solar modules, wind turbines and battery packs.

“Against this backdrop, a 27 per cent increase in energy transition investment in 2021 is an encouraging sign that investors, governments and businesses are more committed than ever to the low carbon transition, and see it as part of the solution for the current turmoil in energy markets.”

Investment in electrified transport was the second biggest category, with electric vehicle sales up 77 per cent.

However investment fell in 2021 in one standout area – carbon capture and storage.

Image: BNEF

Subscribe to our free @AuManufacturing newsletter here.

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos