Is more rare earths processing about to be lost offshore?

Comment by Peter Roberts

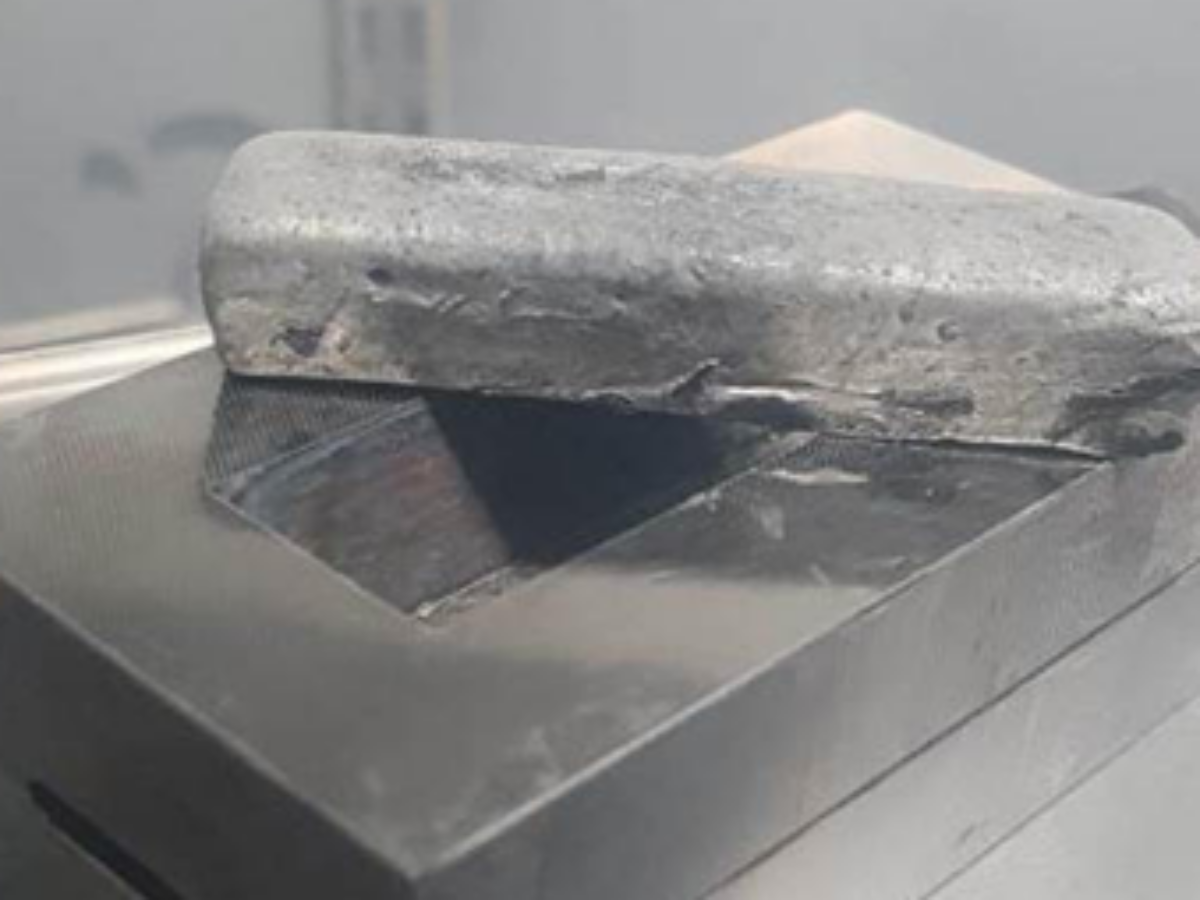

Australian Strategic Materials’ (ASM) Korean research and development partner, ZironTech has successfully produced a kilogramme of neodymium metal alloy.

While this would normally be seen as a win for Australia the fact that production took place in ZironTech’s laboratory in South Korea rings alarm bells.

Neodymium is a critical rare earth used with iron and boron to create powerful permanent NIB magnets for computers, cell phones, medical equipment, toys, motors, wind turbines and audio systems.

There are few sources of rare earths outside China and recent supply chain disruptions have shown the wisdom of onshoring rare earths processing based on Australian minerals.

During the covid-19 pandemic Australia’s biggest rare earths producer Lynas Corporation was forced to close its Malaysian processing facilities.

That company is now relocating some processing closer to its Mt Weld mine in Western Australia.

Lynas should never have been allowed to site such strategic operations offshore, but now the prospect is that ASM’s Australian raw materials will lead to the same result, with value adding this time in South Korea.

The joint venture between ASM, a subsidiary of listed Alkane Resources, and ZironTech is targeting 45 per cent less energy use in its rare earth metallisation process than in traditional processes.

The creation of the alloy is the first stage of production, with the next step electrorefining to produce a 99.9 per cent purity Nd metal to be completed this month.

Following that a commercial pilot plant sited in South Korea will process larger quantities of neodymium and praseodymium metal alloys.

Praseodymium is another rare earth primarily used as an alloying agent to produce high strength metals, including those used inside jet engines.

ASM managing director David Woodall said: “This is a major milestone in ASM’s integrated strategy that includes clean metal production for all products from the development of the Dubbo Project in Central West NSW.

“Integration of metal production into ASM’s business is consistent with the Australian Government’s objective of adding value within Australia, while ensuring supply security of these critical materials to global and Australian manufacturing sectors.”

It is simply not apparent how overseas processing can be classed as adding value within Australia, nor how it ensures supply in case of disruption to supply chains.

This story has been edited to clarify the ownership of the processing IP, which is by South Korea.

Picture: Australian Strategic Materials/1kg Neodymium (87%) metal alloy

Subscribe to our free @AuManufacturing newsletter here.

@aumanufacturing Sections

Analysis and Commentary Awards Defence Manufacturing News Podcast Technology Videos