PPK Group’s difficult transition to be a technology company

By Peter Roberts

PPK Group held its course for its transition from mining equipment manufacturer to technology commercialisation company in the past year, but not without experiencing failures in its technology portfolio and – like many young technology companies – a big fall in its share price.

According to executive chairman Robin Levison (pictured, below) the past financial year which saw the group demerge its mining equipment business was one of scientific highlights, ‘but also some investment lowlights’.

The company’s share price has been on a downward trajectory from $21.95 a year ago to around $1.60 today, a greater fall than has been experienced by its tech company peers.

There are a number of reasons for this, including the initial euphoria around the $34 million IPO of PPK’s 50 percent owned battery technology business Li-S Energy evaporating, leading to investors to undervalue its remaining investments.

The company nonetheless has loyal core shareholders and has learned the lesson that in today’s investment environment, great science and great technologies are not in themselves enough.

As chairman Robin Levison said: “The last six months of this financial year have been a difficult one for our shareholders with the significant disruption to the global investment markets, particularly the technology sector, and the large decline in PPK’s share price.

“…While this year we have successfully achieved three key objectives…the next major objective is to commercialise the technology.”

The factor that really changed PPK was the demerger of the company’s profitable mining equipment business – shareholders in PPK received one share in a unlisted separate mining equipment business for each PPK share they owned.

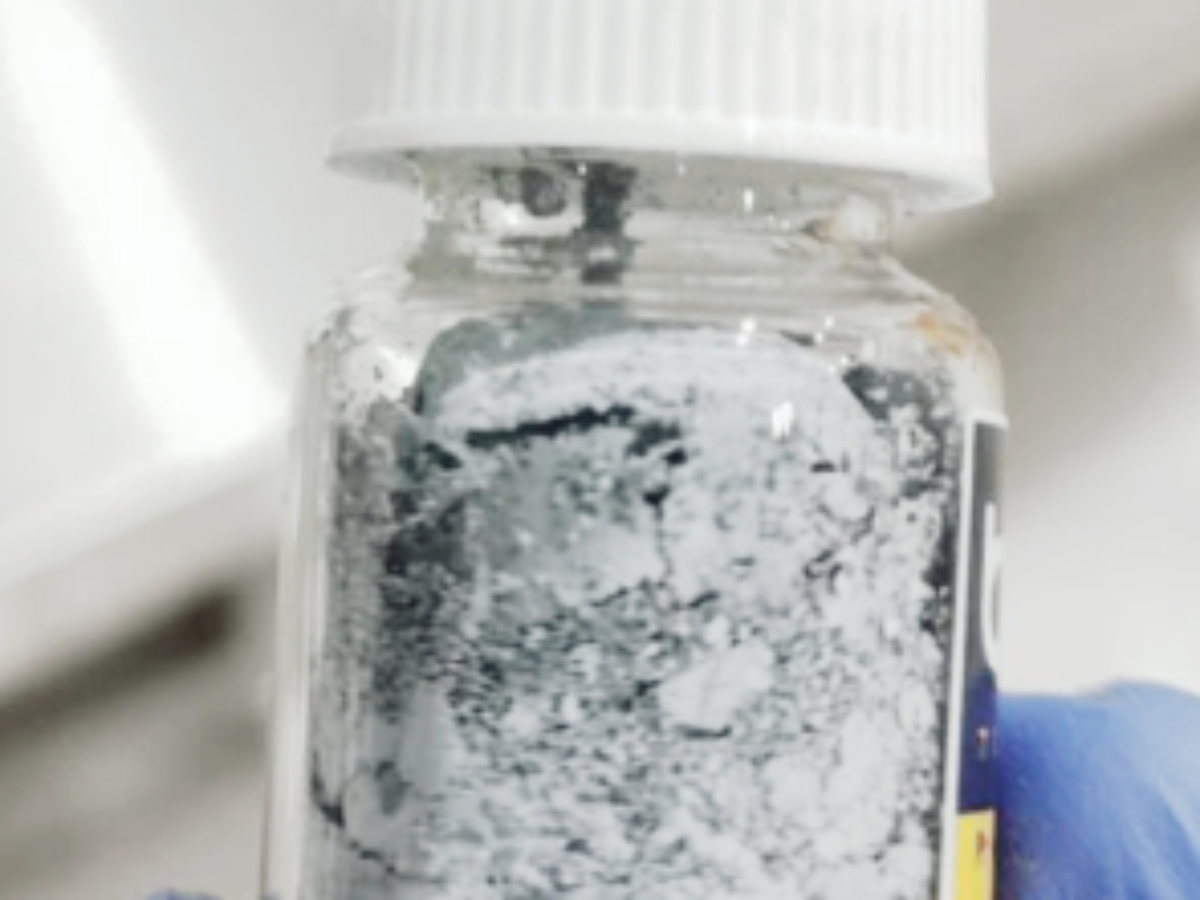

What this has left is a multi-headed technology house based on the core of a new and relatively little known material boron nitride nanotobes (BNNTs) – they are like carbon fibre nanotubes in their strength but have different properties.

In pursuing this technology path the company’s core relationship is with the Institute for Frontier Materials at Deakin University in Geelong. PPK has more recently extended its alliances to the University of Queensland, through an investment in UQ spin out, traffic control software business Advanced Mobility Analytics Group Pty Ltd (AMAG).

During the latest year the focus has been firmly on commercialisation of specific uses for BNNTs.

The company has seen progress on its White Graphene product subsidiary and product – essentially boron nitride nanosheets – incorporated into polymers and resins as well as gelcoat coatings.

White Graphene had a successful $2 million capital raising in September, 2021, and is currently seeking to raise up to $8.6 million.

Levison said: “While global investment markets are extremely difficult, it is reassuring to see investor support good opportunities presented by the group.”

The company’s foray into using BNNT’s to reinforce precious metals is also appearing positive.

Meanwhile the most successful offshoot, Li-S Energy has spent the year increasing the cycle life of its lithium sulphur batteries, which have a specific energy capacity almost three times that of a conventional lithium sulphur battery.

Li-S energy has achieved sustained performance over 1,000 charge/discharge cycles while maintaining this promisingly high energy density.

It has also extended its technology to the development of another high energy density technology, lithium metal batteries.

But as Levison said: “As with any scientific testing, it is not feasible nor expected to achieve success with every test.”

As a result PPK has halted support for a project to infuse BNNTs into dental materials as a reinforcement and two other projects have failed to progress ‘significantly’ – the blending of BNNT’s into bullet resistant glass, and into ceramic polymer materials for body armour.

Additionally a company investment in Survivon ‘has not progressed as we would like’, with Therapeutic Goods Administration approvals taking months longer than expected and reduced medical mask usage impacting PPK financially.

Looking to the year ahead Levison said he expected the White Graphene and Precious Metals to be PPK’s next investments to reach commercialisation and return value to shareholders.

And its Craig International Ballistics armour business is poised to enter the aerospace composites market.

Levison said: “For some applications we have sufficiently proven the science and production – we must now increase the focus on marketing and sales.”

Picture: PPK Group/Boron Nitride Nanotubes (BNNTs)/Robin Levison

@aumanufacturing Sections

Analysis and Commentary Awards Defence Manufacturing News Podcast Technology Videos