PPK turnaround continues with modest loss

Mining products and services group PPK has continued its turnaround cutting its losses from $1 million the previous corresponding period to only $50,000 in the first half of the financial year.

The maker of Rambor and PPK Mining Equipment boosted revenues 11 per cent to $22.05 million in the half, withd a $3 million EBITDA in its mining businesses offset by the costs of diversification.

Mining equipment sales were hit by trade uncertainties between China and the US and a 34 per cent drop in coal prices during 2019 which cut sales to coal mining customers.

PPK, formally Plaspak Group, has been increasing its focus on production, technology, safety and automation products and services that primarily target the underground coal market.

It is electrifying a range of battery powered underground mining vehicles in conjunction with its customers.

The company continues to bed down its acquisition of BNNT Technology, a joint venture which is commercialising a new boron nitride nanotube manufacturing technology developed by Deakin University.

BNNTs have superior mechanical properties and are stronger than high-strength steel and industrial-grade carbon fibre.

Deakin and the company are developing a lithium-sulphur battery application and commercialising a flexible battery developed by Deakin.

PPK has also acquired a 45 per cent stake in Craig International Ballistics which will further utilise BNNTs to enhance its bullet resistant products.

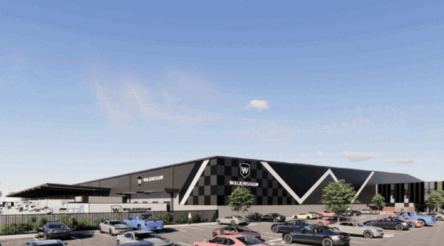

Picture: PPK Group

Subscribe to our free @AuManufacturing newsletter here.

Topics Manufacturing News

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos