Quickstep rejects offer as not reflecting company value

Aerospace composites manufacturer Quickstep has rejected as inadequate a takeover offer tabled on Thursday by a group of Australian defence contractors represented by ASDAM Operations, a company majority owned by CPE Capital.

CPE Capital specialises in growing mid-sized businesses by providing development capital, and has investments in a wide range of businesses, including manufacturers.

ASDAM Operations, made up of leading companies Marand, Levett Engineering, Rosebank Engineering, TAE Aerospace, and RUAG Australia, pitched its offer at 40 cents, a 105 percent premium to Quickstep’s closing price on Wednesday and a 45 percent premium to the average price over the past three months.

Quickstep told investors: “The preliminary view of the board of Quickstep is that the offer does not adequately reflect the value for the company.

“The board, with the assistance of Miles Advisory Partners as financial advisor and Maddocks as legal advisors, continues to consider the offer and to evaluate its strategic, financial and operational implications for shareholders.

“Following this evaluation, the Board will issue a formal recommendation to shareholders, including reasons for that recommendation.”

Quickstep said its board remained open to continuing constructive discussions with ASDAM in respect of a control transaction.

“At this time, there is no need for shareholders to take any action in relation to the Offer or any documents that shareholders may receive from ASDAM.”

Quickstep has undergone extensive restructuring of its businesses this year, including its key structures manufacturing business. The company also closed its loss-making maintenance operation.

Further reading:

Quickstep shares double on takeover bid

Quickstep clears the decks for return to growth, profit

Mark Burgess to leave Quickstep, Demi Stefanova is interim CEO

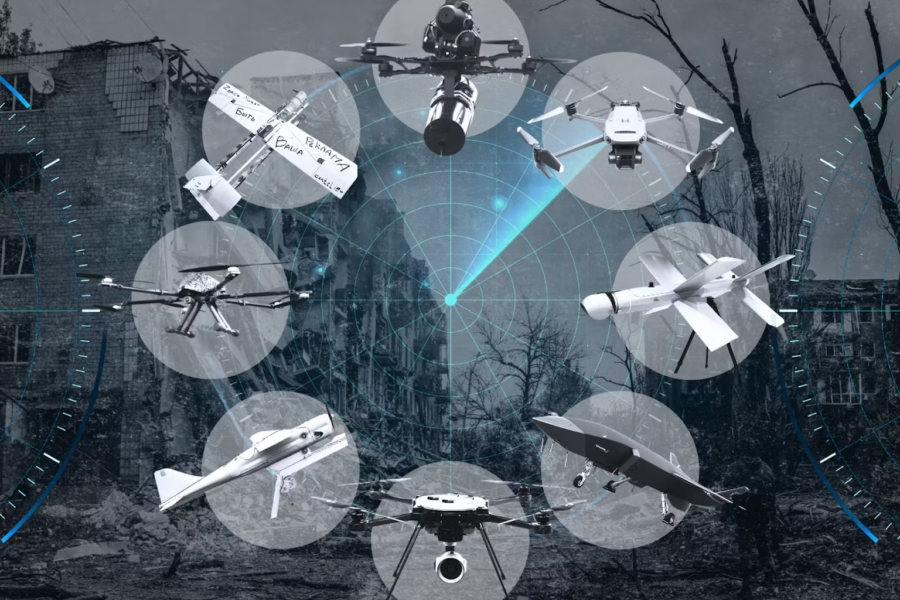

Picture: Quickstep/mould for drone production, Quickstep Bankstown facility

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos