Australia’s place in the semiconductor world: the current ‘state of the world’

In the second day of our Australia’s place in the semiconductor world editorial series, Glenn Downey and Steven Duvall provide part two of their four-part feature. Here is a look at what certain nations are doing to respond to the challenges of the era.

1) Introduction

The article continues our four-part series on semiconductors and their significance for our economy, jobs, productivity and security.

Part 1, published yesterday, provided information on semiconductors aimed at an audience with little or no background on the subject. A high-level overview of the fundamental properties of semiconductors led to a discussion of the industry and the impacts it has had.

In this Part 2 of the series, we examine the impacts of recent shortages of semiconductor components, the vulnerabilities they have revealed in global supply chains, and the responses they have prompted by countries around the world.

In Part 3, we will examine the significance of semiconductors for Australia and consider some of the challenges faced by the nation as it seeks to grow its semiconductor industry.

In Part 4, we explore opportunities for Australia in the semiconductor industry.

2) The chip shortage and its impacts

Recent chip shortages have placed the semiconductor industry in the unusual position of making headline news around the world. The chip shortages slowed and, in some cases, stopped production of consumer goods, such as automobiles, appliances and even soap, directly impacting ordinary citizens, and generating unusual levels of attention in the popular press.

The shortages also generated rarely seen levels of attention in governments, which awoke to an unwelcome reality: national economies, security, and, to a large extent, ways of life are highly dependent on semiconductor components, most of which are manufactured in unreliable parts of the world.

2.1) Supply-chain fragility

The chip shortages were triggered by the COVID-19 pandemic, which increased demand for digital products, while reducing production capacity through staffing issues caused by health restrictions. The shortages were exacerbated by geographically localised incidents, including natural events such as earthquakes, fires and energy shortages, and “unnatural” events such as shipping channel blockages and wars. Clustering of fabrication and assembly facilities and the complexity of the global semiconductor supply chain further compounded the problem and exposed many “chokepoints.”

Further, responses to the shortages compounded the problem, as some sectors that rely on semiconductor components, such as automobile manufacturing, reduced their orders in anticipation that the pandemic would cause massive reductions in demand. The newly available chip production ‘slack’ was taken up by demand from communication and gaming companies who benefited from lifestyle changes triggered by the pandemic. When automobile companies realised, many far too late, that they still needed chip supply as Covid restrictions began to ease, the chip fabrication order book was already full for many quarters in advance. Many automobile companies subsequently put in double, and in some cases triple or more, orders to establish inventory, generating ‘whipsaw’ effects into other semiconductor-reliant product markets, which then could not achieve their own timely supply.

Analysis by Goldman Sachs at the height of the pandemic indicated that 169 industries across the world had lost 1 per cent to 20 per cent of their annual gross industry product due to the semiconductor supply issues.

Although it varied across industries, this general effect had an out-sized macroeconomic consequence, causing inflation that precipitated (eventual) interest rate adjustment by the central banks of many countries. To illustrate the effect, the absence of chips for new cars saw hundreds of thousands of nearly completed vehicles sitting in car manufacturer lots awaiting low-value yet crucial semiconductor components. The decline in new cars available to the market pushed up used car prices. In the US, the consumer price index (CPI) for used cars and trucks rose by almost 30 per cent over the 12 months ending in May 2021 and accounted for about one-third of the total overall monthly CPI increase. What happened in the automotive sector played out in many industries, with a combined global economic effect contributing to rising inflation.

Among other effects, semiconductors are now viewed as “strategic,” critical to the fortunes of a country’s economic prosperity and national security, regardless of the size of the country or its stage of economic development.

2.2) Layering in geopolitics

Adding to these supply chain shocks have been geopolitical concerns, which have led to changes in export and import control regimes and encouragement of greater “reshoring” or “friend-shoring” of the semiconductor supply-chain amongst like-minded nations.

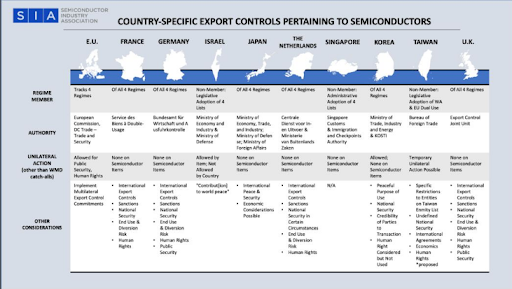

Figure 1, from the US-based Semiconductor Industry Association, compares semiconductor-related export control regimes of ten countries and regions with significant semiconductor industries.

Figure 1 Source: SIA Encourages the United States and Europe to Collaborate on Export Control Policy – Semiconductor Industry Association (semiconductors.org)

Figure 1 Source: SIA Encourages the United States and Europe to Collaborate on Export Control Policy – Semiconductor Industry Association (semiconductors.org)

Perhaps no country has gone further in its response than the US, which introduced a comprehensive suite of programs designed to encourage the development of domestic supply capability and discourage China’s competing capability. If technology ‘decoupling’ between the US and China was previously being played out as a shadow war on many fronts, these definitive US steps on semiconductors mark what a number of commentators are referring to as the new Cold War: the Chip War.

Australia’s response has been far more muted. Although not a major importer of semiconductor components, Australia does rely heavily on the supply of critical components, modules and systems, many of which incorporate semiconductor components produced in the same ‘risky’ countries.

Market cycles

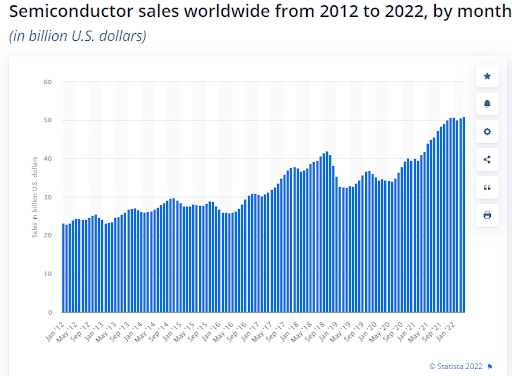

From its inception, the semiconductor industry has experienced highly volatile growth, with periods of rapid growth in sales followed by often steep declines, as shown in Figure 2 and Figure 3.

Figure 2 Source: Global semiconductor sales by month 2022 | Statista

Figure 2 Source: Global semiconductor sales by month 2022 | Statista

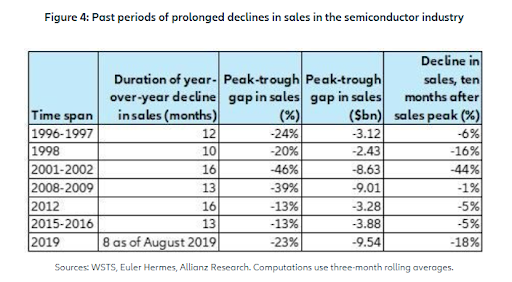

Figure 3 Figure 3 Source: A 2020 semiconductor slump will send shockwaves across the global electronics industry (allianz-trade.com)

Figure 3 Figure 3 Source: A 2020 semiconductor slump will send shockwaves across the global electronics industry (allianz-trade.com)

The two biggest factors causing the swings in the market are inventory levels and worldwide economic growth. Both factors are now aligned to cause another decline in semiconductor sales over the next two to five years. Specifically, over that period, subdued global economic growth is expected to coincide with an over-supply of semiconductor components caused by the surge in new fab construction triggered by the recent chip shortages.

However, as discussed in Section 4, there are many market segments across, up and down the supply chain, creating potential opportunities regardless of the economic cycle.

This makes the industry robust and “evergreen” with new opportunities. A downturn in the semiconductor industry, as a whole, will not affect all segments of the industry equally. Thus, over the next few years, we would expect growth to continue in segments that are currently experiencing rapid growth due to a transition in semiconductor technology, such as the transition from silicon to compound semiconductor power switches, or due to a broader technological trend, such as the transition to electric vehicles. Furthermore, new fab construction will not increase capacity uniformly, so chip shortages will persist in some sectors of the industry. There will continue to be compelling opportunities for new companies with new semiconductor products, as has been true since the start of the industry.

3) Responses to the semiconductor challenge: the drive for self-sufficiency

The vulnerabilities of global supply chains “painfully exposed” by the chip shortages have triggered countries around the world to respond with huge investments to boost their domestic semiconductor industries, especially manufacturing, with the stated goal of increasing their self-sufficiency.

The drive for increased self-sufficiency in semiconductor components aims to:

- Protect and grow domestic manufacturing of semiconductor components and products that depend on semiconductor components, and

- Reduce dependency on foreign manufacturers, especially in at-risk countries, for critical components.

In the last two years alone the following major, government-led initiatives have been announced.

United States

- US CHIPS and Science Act – US$52.7 billion in subsidies earmarked to support domestic semiconductor manufacturing and research (US$39 billion for new fab construction)

European Union

- EU Chips Act – US$30-50 billion available with intent to double the EU’s global market share to 20 per cent by 2030

- France – US$1.9 billion investment into joint EU projects for semiconductors

- Germany – US$12 billion in microelectronics projects announced

Japan

- US$6.8 billion made available for domestic semiconductor investment; 80 per cent directed to cutting-edge fabs with up to 50 per cent setup cost subsidy; TSMC-Sony joint fab for Japan announced

Korea

- “K-Semiconductor Belt” strategy. Includes circa US$452 billion investment in semiconductors by 2030; 20 per cent tax credits for new fabs

Taiwan

- “Invest in Taiwan” initiatives

15 per cent R&D tax credit; income tax exemptions for royalties on imported production technologies; import tariff exemptions for companies located in Science Parks

Singapore

- Longstanding national government tax, land, capex and labour cost incentives provided pre-dating 2020.

- Reportedly TSMC is in private discussions with Singapore’s Economic Development Board regarding incentives for Singapore based chip fabrication facility.

China

- 2014 Guidelines to Promote National Integrated Circuit Industry aligned to Made in China 2025 policy commenced in 2014 with aim of semiconductor self-sufficiency rate of 40 per cent by 2020 and 80 per cent by 2030

US$50 billion estimated investment; corporate income tax exemptions and imported semiconductor equipment for sub-28 nm, sub-65 nm, sub-139 nm fabs; over 10 new fabs announced.

India

- Up to US$30 billion available for ‘global hub for electronics manufacturing with semiconductors as the foundational building block’

- US$10 billion Production- and Design-Linked-Incentive programs for semiconductors; up to 50 per cent government co-funding on offer depending on nanometre process planned

4) Is self-sufficiency possible?

To speak of just one semiconductor market misses the complexity of the industry. As a Forbes article noted late last year:

“There are more than 30 types of semiconductor product categories (at least) …any one of which may require up to 300 different raw material inputs…processed by more than 50 classes of highly engineered precision equipment…incorporating hundreds of technology subsystems…”

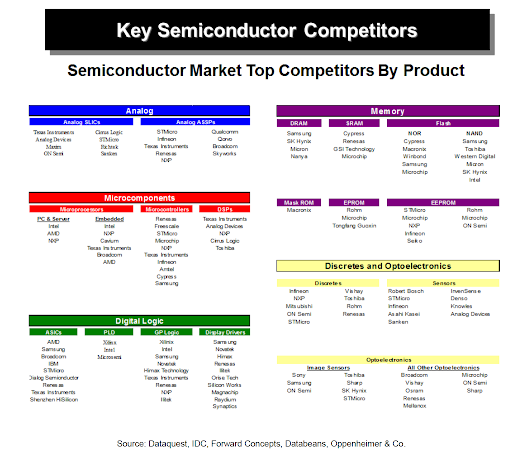

The large number of semiconductor products reflects this complexity. Figure 4 shows leading categories of semiconductor products as of 2017, with leading competitors identified. Each category of product is further segmented. For example, microprocessors are segmented by performance (entry-level versus high performance), application (server versus desktop versus notebook) and other aspects. Furthermore, each competitor has their own unique products, which are typically not interchangeable. There are literally millions of different semiconductor products on the market at any point in time.

Figure 4 Source: R. Schafer, J. Buchlater, Semiconductors: Technology and Market Primer 10.0, Oppenheimer & Co, Inc. 2017

Figure 4 Source: R. Schafer, J. Buchlater, Semiconductors: Technology and Market Primer 10.0, Oppenheimer & Co, Inc. 2017

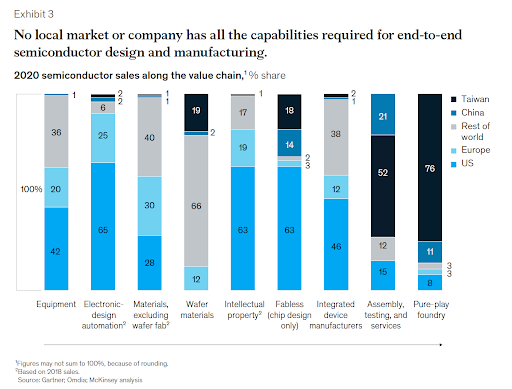

Semiconductor supply chains also reflect the complexity of the industry. As shown in Figure 5, no region, local market or company has end-to-end capabilities for semiconductor design and manufacturing.

Figure 5 Source: O. Burkacky, et. al. “Strategies to lead in the semiconductor world,” McKinsey & Company, April 2022.

Figure 5 Source: O. Burkacky, et. al. “Strategies to lead in the semiconductor world,” McKinsey & Company, April 2022.

The complexity of the industry creates enormous barriers to achieving self-sufficiency. An analysis by BCG and SIA estimates that an investment of “over $400 billion in government incentives” and a cost of “more than one trillion dollars over ten years” would be required for the US to achieve complete manufacturing self-sufficiency of semiconductor components currently consumed in the US.

Thus, complete self-sufficiency is not practical for any country. Instead, each country will need to decide where to seek opportunities and build capabilities, considering stages in the semiconductor supply chain, different technologies, types of products and applications. This will require a combination of nuanced assessment of future market opportunities and an element of placing calculated bets in a game where being at the table is a prerequisite for national growth and security.

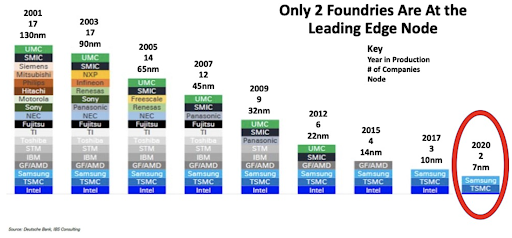

Decisions of where to place these bets are complex and multi-dimensional and new players face huge barriers to entry at most stages of semiconductor value chains. For example, as shown in Figure 6, the number of foundries at the leading-edge technology node has declined from 17 in 2001 to 2 in 2022, reflecting the enormous cost, complexity and know-how required in advanced semiconductor manufacturing. Practically, manufacturing at the most advanced nodes of semiconductor technology is out of reach of new players. On the other hand, there are still significant markets and value in play at older, ‘legacy’ nodes. Indeed, in January 2022 Apple’s CEO, Tim Cook, noted to analysts that “our biggest issue is chip supply, it’s chip supply on legacy nodes. … we’re doing okay on the leading edge stuff.”

Figure 6 Source: https://gordianknot.stanford.edu/sites/g/files/sbiybj22971/files/media/file/The%20Semiconductor%20Ecosystem.pdf

Figure 6 Source: https://gordianknot.stanford.edu/sites/g/files/sbiybj22971/files/media/file/The%20Semiconductor%20Ecosystem.pdf

5) Conclusion

The panicked response to the chip shortage of the last few years reveals the strategic importance of semiconductors. The highly distributed supply chain, complexity of technologies and products and huge investments required make complete self-sufficiency unrealistic for most, if not all, countries. Instead, each country will need to decide how to best address its strategic interest in the semiconductor industry, deciding where to place its bets and with what other countries they should align themselves.

In part 3 of this series, we will examine the current state of the semiconductor industry in Australia, the importance of semiconductors for the nation and steps it can take to address its strategic interests.

Main picture: credit Intel Corporation

Dr. Steven Duvall has been in the semiconductor industry for nearly 40 years since completing his PhD at Stanford University in 1983. He spent 18 years with Intel in California driving corporate initiatives in design for manufacturability and six years with Intel in Australia supporting Intel Capital globally with technical and commercial due diligence of entrepreneurial companies. He spent 14 years with Silanna Semiconductor, an Australian developer and manufacturer of advanced semiconductor components, where he was the Chief Technology and General Manager of Ultraviolet Products.

Glenn Downey is Executive Director of The Maltby Group. Glenn was the primary author of the NSW Office of the Chief Scientist and Engineer’s ‘Australian Semiconductor Sector Report’ (2020). Glenn co-founded and led Sydney based OFDM cable modem technology developer Aurora Communications Limited through till its acquisition by ADC Telecommunications, led the investment and commercialisation activities for Redfern Photonics, the commercialising vehicle for the Australian Photonics CRC, and was Commercialisation Director at NICTA prior to its merger with CSIRO.

@AuManufacturing![]() and AUS-Semiconductor-Community’s editorial series, Australia’s place in the semiconductor world, is brought to you with the support of ANFF.

and AUS-Semiconductor-Community’s editorial series, Australia’s place in the semiconductor world, is brought to you with the support of ANFF.

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos