GM invests in Queensland battery metals group

General Motors is among critical mineral hungry investors who have backed a $16 million capital raise by battery materials maker Queensland Pacific Metals.

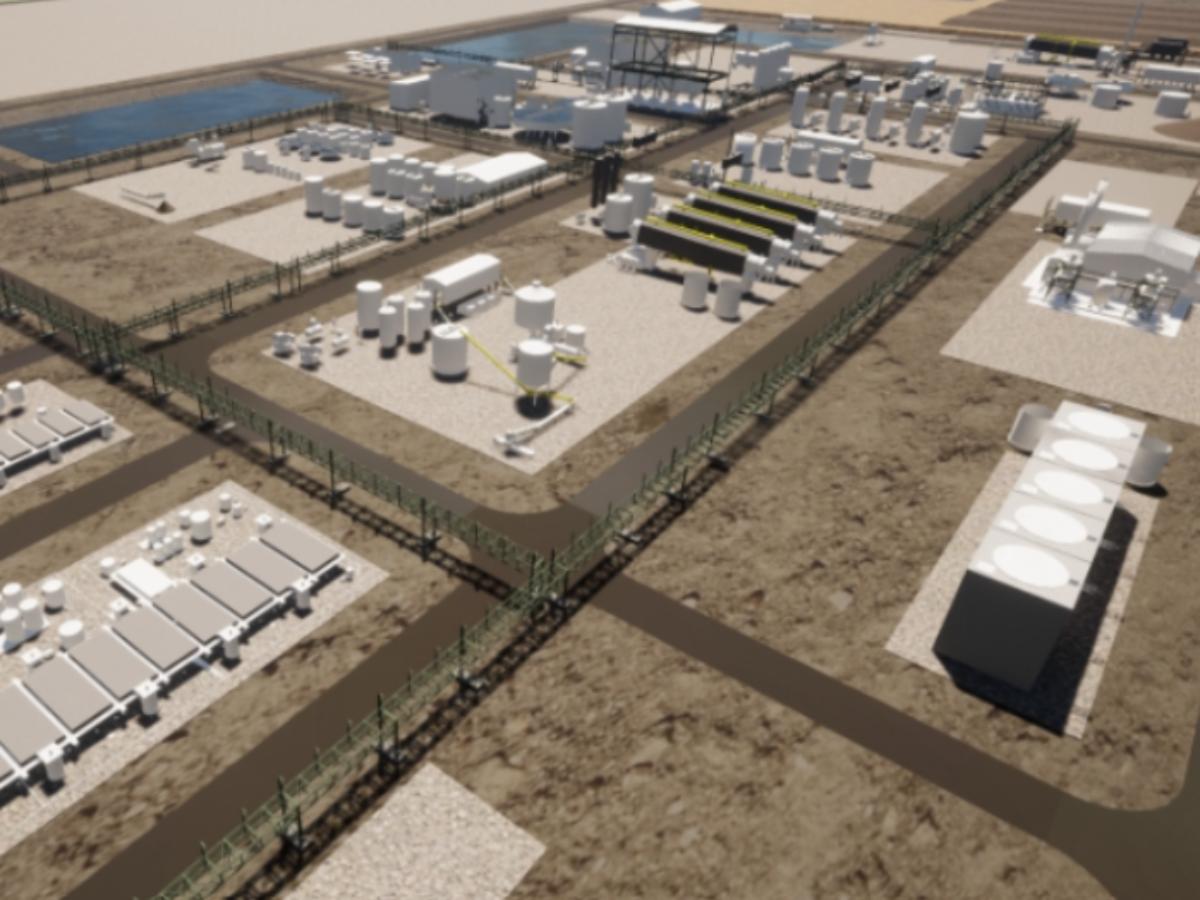

The automotive company is staking its claim to a share of production of nickel sulfate and cobalt sulfate from QPM's 100 per cent-owned Townsville Energy Chemicals Hub (TECH, pictured) Project, about 45 kilometres south of Townsville.

The investment is in line with GM's existing shareholding in QPM of just under 10 percent.

The Hub, which will process high-grade laterite ore imported from New Caledonia, will also supply South Korea's Posco and LG Energy Solutions under binding offtake agreements.

The capital raise also includes a $5 million strategic investment from ore supplier Societe des Mines de la Tontouta (SMT). SMT will also explore further investment.

QPM, which reported reported in August success in pilot production of nickel sulfate at the facilities of SGS Canada, will now launch an $8 million share purchase plan to existing shareholders, bringing the total to be raised to $24 million.

The aim is to produce battery-grade nickel sulfate and cobalt sulfate using the proprietary DNi process (owned by Altilium Group) at TECH from high-grade laterite ore mined in New Caledonia.

Funds will be used to enable gas production at QPM's Moranbah Project and ongoing technical work needed to secure debt financing for the TECH project.

The TECH hub will be powered by gas derived from coal at an established coal mine waste gas project at Moronbah, Queensland capable of processing up to 30 PJ per annum.

SMT General Manager Arnaud Bondoux said: “Today's investment is the first step in SMT's determination to move down the nickel value chain, beyond its role as an ore supplier, in order to propose a new model for the valuation of New Caledonian ore.”

Further reading:

QPM produces on-spec nickel sulfate in pilot testwork

Picture: Queensland Pacific Metals

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos