Queensland gets back in the venture capital game

By Peter Roberts

The Queensland government is getting back in the venture capital game and directly investing in young – and inherently risky – businesses.

State owned VCs have been on the nose since the failure of the Victorian Economic Development Corporation and subsequent abolition in 1993, its demise as much a result of the recession of the early 90s as it was a failure of public policy.

But that did lead to decades of ‘hands off the market' by government which has only been reversed in recent years as memories fade of the 1980s and 1990s boom and the imperative of economic development has become more acute.

However no state has gone as far as Queensland which has announced the establishment of the Queensland Venture Capital Development Fund (QVCDF).

The fund has locked in deals with five major venture capitals firms Antler, Five V Capital, Main Sequence, Mandalay Venture Partners and Salus Ventures.

The deals mean Queensland start-ups will have access to up to $200 million in new matched funding as these investors grow their presence, focus and investment in the local innovation sector.

In response to significant demand for the QVCDF, managed by Queensland Investment Corporation (QIC), the Miles Government has committed a further $55 million to the programme – bringing the state's investment to $133 million.

The first investments to close in the Matched Funding stream are:

- Antler – a global early-stage VC operating across six continents, investing in startups including Pathzero, Upcover and Xailient

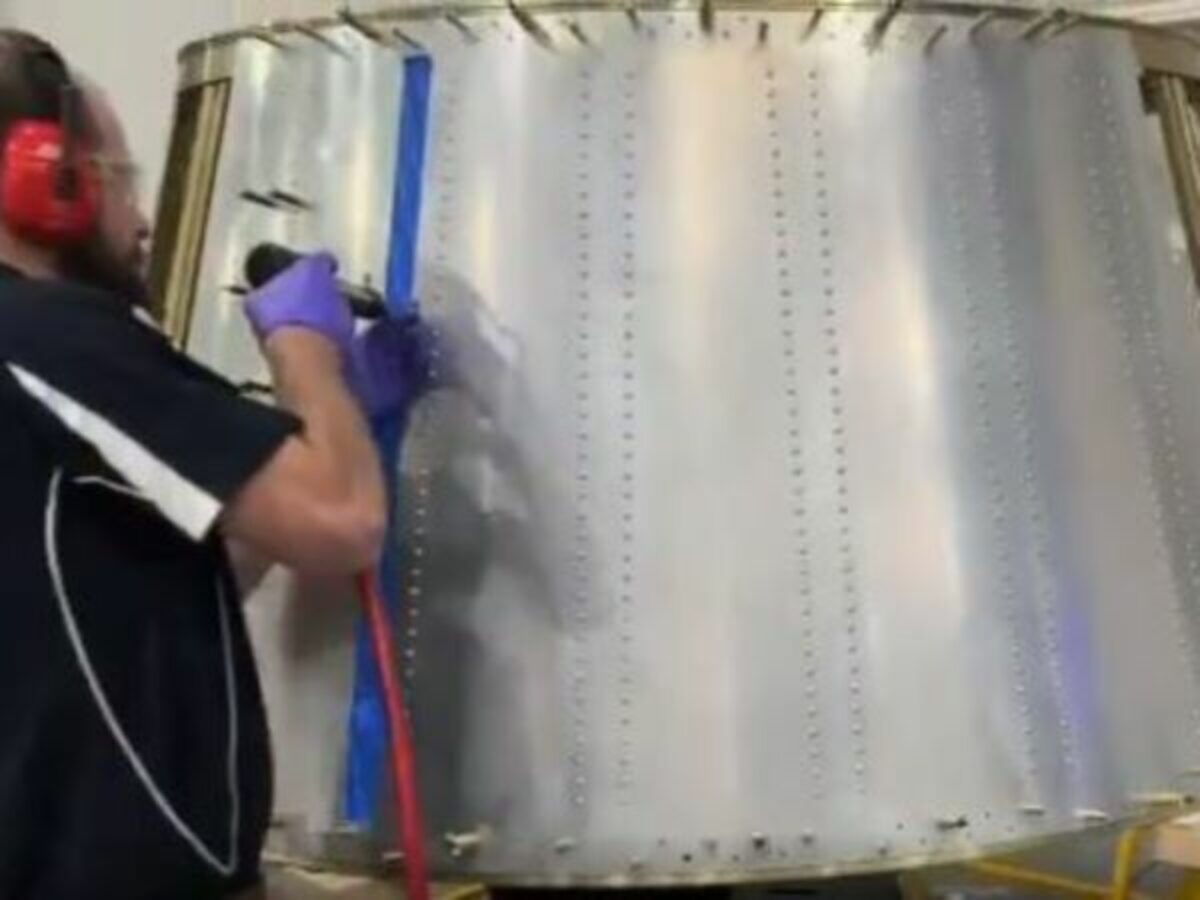

- Main Sequence Ventures – originated by CSIRO to bridge the divide between research and commercialisation, Main Sequence has Queensland investments including Gilmour Space Technologies, Endua and Rainstick.

- Five V Capital – the growth partner to some of Australia’s leading companies has invested in Brisbane-based start-up Dataweavers.

- Salus Ventures – Australia’s first early-stage fund dedicated to the intersection of critical sovereign technology and its commercialisation

- And Mandalay Venture Partners – Queensland-based venture fund backing farm-to-fork innovation.

The Deputy Premier, Treasurer and Minister for Trade and Investment Cameron Dick said: “In making more capital available, businesses do not need to leave our state to pursue funding elsewhere – they can establish, grow and remain in Queensland.

“Together, we can nurture Queensland’s famous entrepreneurial spirit and let the brightest minds shine in the Sunshine State.”

Antler Australia Partner Mike Abbott said the support would help in establishing more than 15 companies over the next four years .

Only a minority of these investments will be in manufacturing, but the sector is represented at the start and also is a feature of broader state government policies.

The big difference between today and that of the VECD is the greater maturity of the venture capital sector.

When the VEDC was set up there were only as tiny handful of investors and the VEDC invested directly. Today investing can be done by full time professionals who have a track record of investing.

And of course the Queensland government right now is flush with cash.

Such investing is risky yes, but less so than in the 1980s and 1990s.

Picture: Gilmour Space Technologies is venture capital backed

Topics Analysis and Commentary Antler Dataweavers endua Five V Capital Gilmour Space Technologies Main Sequence Mandalay Venture Partners Manufacturing News Mike Abbott Pathzero Queensland Investment Corporation Queensland Venture Capital Development Fund Rainstick Salus Ventures Upcover and Xailient Venture capital Vicotirn Economic Development Corporation

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos