Silex confirms twin technology path, makes loss

Industrial technology group Silex Systems (ASX: SLX) has confirmed its plans for the commercialisation of its two lead technologies and announced a loss for the first half of the year.

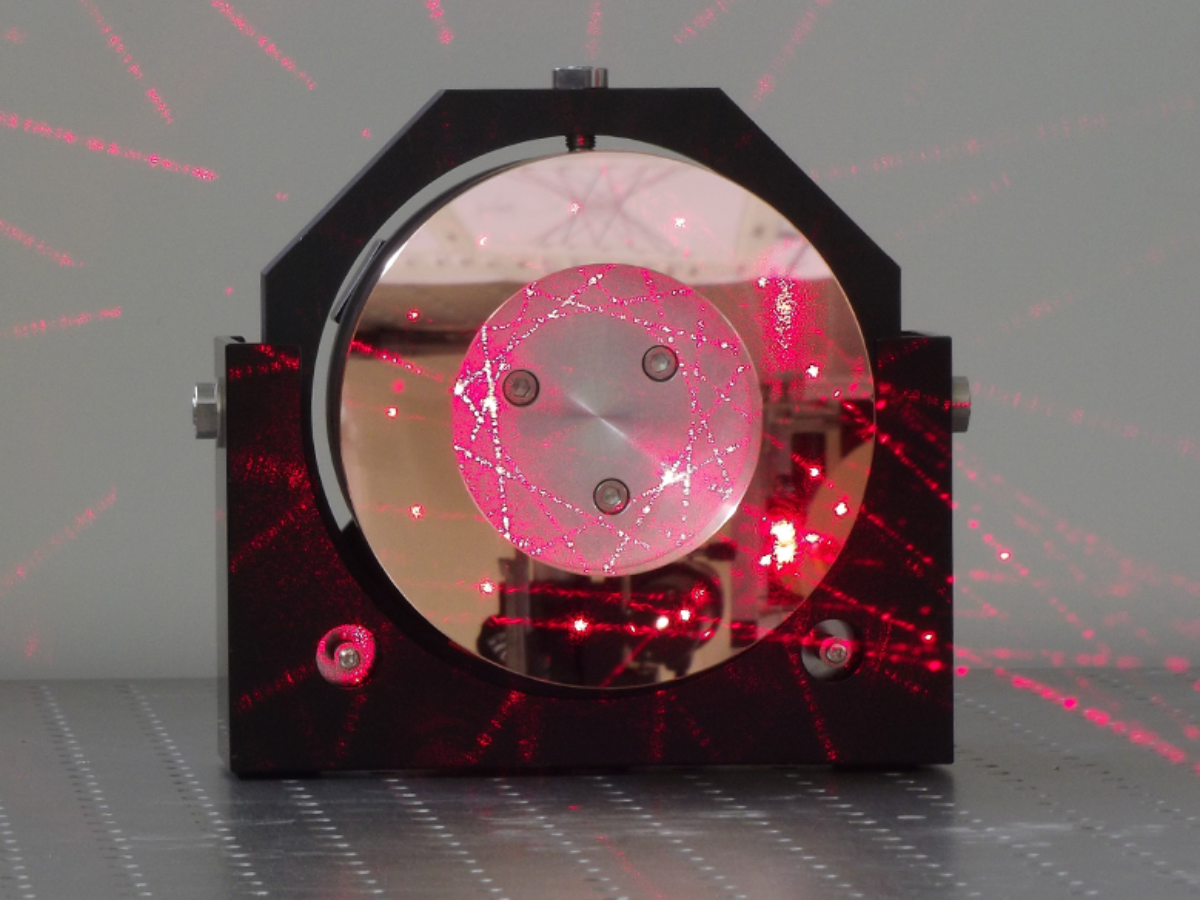

In an announcement to the stock exchange, the company confirmed a report in @AuManufacturing of its purchase from GE of its laser enrichment process for uranium, in association with a Canadian mining firm.

It also reported a net loss of $1.8 million, down from $3.7 million in the previous corresponding period, largely due to a reduction in expenses.

The company saved $2.8 million by reducing development costs of of its SILEX technology and outgoings for consultants and professional fees.

The latest announcement said Silex continued negotiations to take 51 per cent, and Canadian miner Cameco Corporation 49 per cent of 51GE Hitachi Nuclear Energy’s stake in Global Laser Enrichment (GLE).

The transaction “provides an deal path to market for GLE and the SILEX technology in the US,” the announcement said.

“A reduced but focused technology development programme continues at both the company’s Lucas Heights facility (in Australia) and GLE’s Wilmington test Loop facility (in the US).”

Siles has assets in the order of $40 million to continue commercialisation of the Separation of Isotopes by Laser EXcitation (SILEX) enrichment technology for uranium.

Silex also updated the market on the sale of its stable isotope separation technology, cREO, to UK-based IQE which netted the company US$5 million in the form of IQE stock.

IQE is a leader in manufacture of semiconductor wafer products and has been developing uses for cREO at its North Carolina plant.

Silex said the technology showed promise for the manufacture of next generation devices in the semiconductor, digital communications and power electronics fields.

“Product trials and preliminary qualification activities within the IQE group and with select commercial partners continues.”

Silex holds the rights to royalty streams from both technologies.

Picture: Silex

Subscribe to our free @AuManufacturing newsletter here.

Topics Manufacturing News

@aumanufacturing Sections

Analysis and Commentary Awards Defence Manufacturing News Podcast Technology Videos