Towards 3% R&D – Australia should choose a better target by Dr Matthew Young

Today in our editorial series – Towards 3% R&D – Turbocharging Australia's Innovation Effort – Dr Matthew Young looks at the Australian government's aim of close to doubling R&D spending to the equivalent of 3% of GDP, and concludes it might be better to set a better goal.

Advocating for an increase in Australia’s national R&D expenditure from 1.68% to 3% appears to be a worthy endeavour.

However, this target may seem somewhat arbitrary, as it is based on the averages of OECD economies of varying sizes, blends, and outputs.

Therefore, it's crucial to determine whether this goal is adequate or merely an ambitious aspiration beyond reach.

Disparities in R&D Spending Across Industries

It is essential to recognize that R&D expenditure varies significantly across industries.

For instance, within the Australian manufacturing sector, reported investment in R&D totals $5.2 billion. As a percentage of manufacturing's contribution to GDP, this figure stands at 4.2%.

Notably, this calculation excludes government and higher education investments and when these additional factors are considered, manufacturing R&D spending surpasses 6% of manufacturing GDP, far exceeding the national average of 1.68%.

This substantial investment in manufacturing R&D is unsurprising given the sector's ‘complexity' and the constant need for both incremental and disruptive innovations to remain competitive.

In contrast, the mining sector, primarily focused on the ‘lower complexity' business model exporting raw or minimally processed materials, needs only to allocate a mere 0.2% of its GDP to R&D.

Therefore, to enhance the ‘complexity' of Australian industries, a topic frequently discussed here at AuManufacturing, there is a clear imperative to increase onshore processing and manufacturing of Australia’s mineral resources, necessitating greater research funding from industry, government, and higher education institutions.

Discrepancies in R&D Spending Among OECD Nations

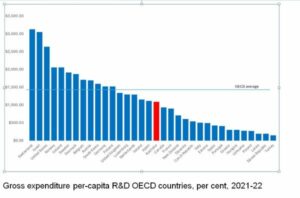

Australia's national R&D expenditure currently stands at 1.68% of GDP, ranking the country 22nd out of 34 OECD nations.

However, this figure lacks nuance as it fails to consider the scale of GDP relative to population, let alone the diverse industries contributing to individual nations GDP.

Consequently, a call to increase R&D spending to 3% of GDP warrants careful scrutiny to ensure its suitability and achievability.

An essential aspect of R&D success lies in the expertise of individuals, people trained in ‘very particular set of skills', often ‘acquired over a very long career' (Liam Neeson, Taken, 2008).

Australia's strong economy juxtaposed with its relatively small population raises questions about how the country compares with other OECD nations on a per-capita R&D spending basis to employ these individuals.

Gross Expenditure on Research and Development (GERD) figures, indicating the share of GDP among OECD countries, expressed as a percentage, sourced from the 2021-22 Science and Research Budget Tables position Australia at 22nd place.

But if the same data is presented in terms of per-capita spending on R&D in US dollars, this notably reorders the rankings of several countries and situates Australia at 18th position.

Given that Australia only moves up by four places, some readers might question the significance of this alternative analysis. However, to address this concern, it's essential to examine specific country examples.

One notable case is Luxembourg – despite its R&D spend being just 1.04% of GDP, ranking it 32nd, Luxembourg boasts a per-capita spend of $US1300, due to its wealth and its relatively small population of just over 650,000.

If there were a push to increase Luxembourg’s R&D spending to 3% of GDP, the per-capita spending would soar to $3,750, surpassing the current OECD average.

However, this target might strain the population's capacity to support it, given the need for other essential services and operations across the nation. Similar situations can be observed in larger countries like Ireland and Norway.

@AuManufacturing is publishing contributions from readers for our series – Towards 3% R&D – turbocharging our national innovation effort – over a, month and will shortly publish contributions in an e-Book. Information: Peter Roberts, 0419 140679 or write to editor@aumanufacturing.com.au.

In contrast, let's consider the case of the Czech Republic. Despite having a higher R&D spend of 2% of GDP, which places it above Australia, the Czech Republic's higher population-to-GDP ratio results in a per-capita spend on R&D of only $544.

Even if its R&D spending were increased to 3% of GDP, the per-capita spend would only rise to $817, falling significantly short of the per-capita investment benchmarks seen in leading countries and a level unlikely to maximise the potential “collective intellectual capacity” of its population.

Setting Realistic Targets for Australian R&D Spending

Increasing Australia's R&D spending to 3% of GDP would position the country between Germany and Finland, ranking 12th overall.

However, in terms of per-capita spending ($US1952), Australia would ranking would advance significantly to sixth overall.

This raises questions about the country's capacity to sustain such a level of investment, particularly considering workforce participation rates and an aging population.

In light of these considerations, it may be prudent to set a more modest target for Australian R&D spending, aligning with recently achieved historical peaks.

A return to the pre-global financial crisis peak of 2.25% of GDP may be a more feasible goal in the near term.

At this level, with a per-capita spend of $1464, Australia would rank 13th, ahead of the UK.

This level of investment, coupled with effective targeted management, should further stimulate GDP growth in subsequent years and elevate Australia's per-capita R&D spending within the OECD.

Dr. Matthew Young is a technology, development, manufacturing, and materials expert with over 20 years of leadership experience in research, development, and translation. He currently provides independent technical advisory services to Australian industries and researchers.

This series is brought to you through the support of our principal sponsor, public accounting, tax, consulting and business advisory BDO, and R&D tax incentive consultancy Michael Johnson Associates.

Picture: Dr Matthew Young

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos