Turkish machine builder makes $2.5 million strategic investment in Titomic

Turkey-based metal forming machine specialist Repkon Makina ve Kalip has become a strategic investor in Titomic, acquiring a $2.5 million stake in the Australian large-scale additive manufacturing business.

Repkon would be issued 9,615,384 ordinary fully shares at 26 cents a share, according to a statement to the ASX by Titomic on Tuesday.

The two companies announced a non-binding heads of agreement in March this year covering a joint venture that would see them establish a factory at an unnamed site in Australia, using Repkon’s designs and Titomic’s production technology to produce gun barrels.

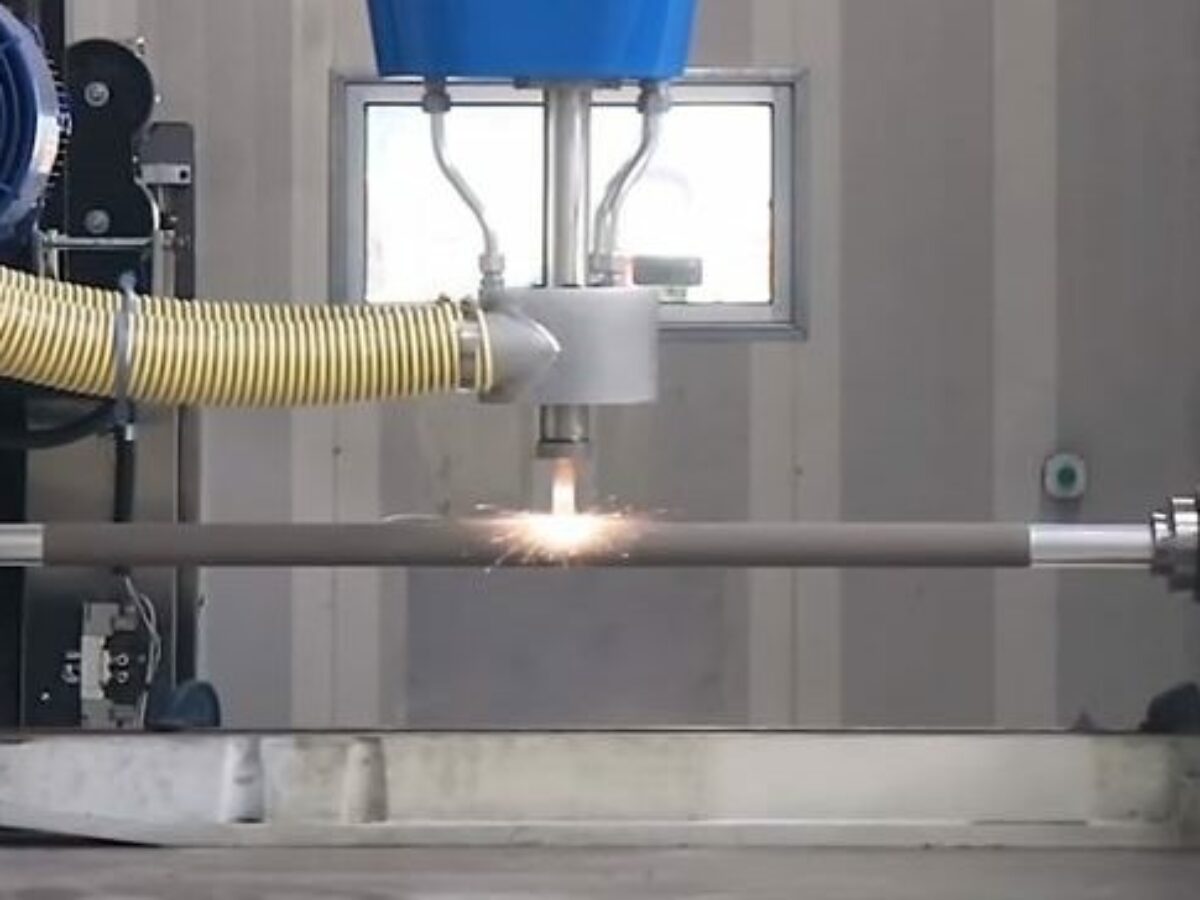

Titomic uses a cold spray-based additive manufacturing process it calls Titomic Kinetic Fusion to build freeform shapes out of metal powders.

Repkon CEO Ibrahim Kulekci said it was the first time his company had made a strategic investment in a supplier.

“However, with the success of our initial joint venture on weapons systems barrels we believe the performance, superior strength-to-weight ratios, enhanced durability and costs advantages these products and manufacturing processes provide will be of keen interest across many areas of tooling that supply the defence and aerospace industries,” Kulekci said.

“Following the signing of the Head of Agreement this investment signals confidence in our technology platform and our strategy to commercialise our TKF technology through a global go-to-market approach which harnesses the benefits of joint ventures and strategic partners,” said Titomic CEO Herbert Koeck in a statement.

The investment from Repkon follows a recent $9 million share placement, also at 26 cents per share. Combined, these would provide the needed cashflow to accelerate commercialisation, said Koeck, “through more joint venture operations, sales and support offices closer to our customers and operational facilities.”

Picture: Titomic

Subscribe to our free @AuManufacturing newsletter here.

Topics Manufacturing News

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos