Australia’s place in the semiconductor world: The industry in Australia and its opportunities

To close out the first week of our editorial series, Australia’s place in the semiconductor world, we turn again to the analysis of Steven Duvall and Glenn Downey. In part three of their four-part feature, they describe what currently exists in Australia, and the challenges to growing this.

1) Introduction

This article continues our four-part series on semiconductors, continuing the themes from the two previous articles.

Part 1 provided background on semiconductors aimed at an audience with little or no background on the subject. A high-level overview of the fundamental properties of semiconductors led to a discussion of the industry and the impacts it has had.

Part 2 examined the impacts of recent shortages of semiconductor components, the vulnerabilities they have revealed in global supply chains and the responses they have prompted by countries around the world.

In this Part 3, we examine the significance of semiconductors for Australia and consider some of the challenges faced by the nation as it seeks to grow its semiconductor industry.

In Part 4, we explore opportunities for Australia in the semiconductor industry and propose a strategy for building the industry here.

2) The current state of the Australian semiconductor industry

The effects of the recent chip shortages were also felt in Australia. As a (currently) small contributor to the semiconductor value chain, the direct impacts of the chip shortages were (possibly) less severe for Australia than for other countries. However, many Australian early-stage electronic hardware development companies were especially adversely affected by constrained semiconductor supply. Moreover, the impact on imports of consumer goods has been felt by many Australians and, similar to other governments, the Australian government has become more alert to dependency on foreign sources for critical semiconductor components.

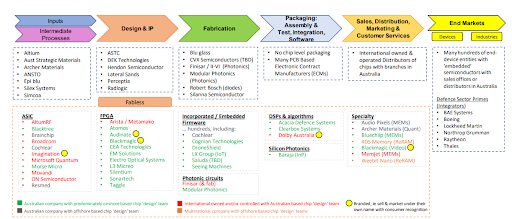

A study published in late-2020 on the Australian semiconductor sector provided representative examples of Australian-based companies and organisations participating across the value chain (see Figure 1). There have been some additions, subtractions and transitions to the specific listing over the last two years, such as AMD acquiring the majority of Imagination’s local ASIC development team, the launch of Quest Semi in Queensland, and Analog Device’s tie-up with a Macquarie University-based lab. However, the landscape today is still broadly consistent with 2020, meaning there are pockets of talent, capability and activity which could provide a basis for future opportunity. Overall, the sector currently lacks the depth, critical mass and coordination that it would politically require to fully realise its economic promise. The case for ‘why it matters’, ‘what specific areas we could and should do’, and ‘how do we get there’ still needs to be voiced, supported and built into plans.

Figure 1 Source: Figure 2 from ‘Australian Semiconductor Sector Study,’ NSW Office of the Chief Scientist and Engineer, 2020; available at Australian-Semiconductor-Sector-Study.pdf (nsw.gov.au)

3) Why semiconductors matter for Australia

The increasing strategic importance of semiconductors makes it imperative that Australia grow its participation in the semiconductor industry. There are opportunities throughout the supply chain, but, arguably, the two value-chain steps of development and manufacturing of semiconductor components are essential.

As discussed in Part 2 of this series, semiconductor components are increasingly strategic products, which some consider the “new oil.” They increasingly underpin our national security, economy and ways of life. Although it is not feasible for Australia, or any other country, to achieve complete self-sufficiency in semiconductors, it is imperative that Australia establish a core semiconductor design and manufacturing capability to provide Defence with trusted domestic sources of (some) critical components and to reduce supply risk for (some) components and fabrication services currently sourced from overseas.

Beyond the strategic imperative, Australia has an economic imperative to grow its semiconductor design and manufacturing capability. Doing so will help Australia build and retain knowledge and skills, driving growth in highly-skilled jobs within the semiconductor industry, developing transferrable skills that will enable the development and production of other emerging technologies and industries, and enabling Australia to realise greater domestic returns from its R&D investments. It will also increase the commercialisation success rate by reducing foundry access barriers and shortening product development lifecycles by reducing manufacturing cycle times.

Figure 2. Sydney based Morse Micro, led by CEO Michael de Nil (pictured), designs and develops low powered long range Wifi chips for IoT uses; source: Enterprise IoT Insights, September 2022

As discussed in Part 1 and Part 2 of this series, the broad range of semiconductor technologies and products place self-sufficiency out of reach. No country, including Australia, can design and manufacture every semiconductor component used in modern electronic systems. Australia will need to be selective in the bets it places. To help guide the selection, we see two objectives in developing the domestic industry:

- Establishing domestic sources of critical semiconductor components, and

- Establishing leadership in select semiconductor market segments that are relevant to Australia, yet have global market opportunity.

The first objective addresses the strategic imperative. The second objective addresses the economic imperative, focusing on sectors in which Australian companies can establish commercial success by establishing product leadership.

4) Challenges in building the semiconductor industry in Australia

Simplistically, an industry consists of companies and the industry will grow as companies within it grow. So, for Australia to grow its semiconductor industry, it will need to grow semiconductor companies operating within the country. We see three ways to achieve that:

- Attract non-Australian semiconductor companies to establish operations in Australia,

- Grow existing Australian semiconductor companies, and

- Establish and grow new semiconductor companies.

Australia has been pursuing all three approaches, to an extent, and, in view of commitments recently announced by other countries, should now significantly increase its own commitments. In the following sub-sections, we expand on each of these options, including considerations of the challenges they present and ways to overcome the challenges.

4.1) Attracting investment by non-Australian semiconductor companies

Non-Australian semiconductor companies have demonstrated a willingness to invest in Australia to acquire intact teams (mostly design engineering teams) or businesses, particularly where the acquisition is linked to existing or potential product leadership. Prominent examples of this include Optium (which acquired Engana and is now part of II-VI), AMD and Broadcom.

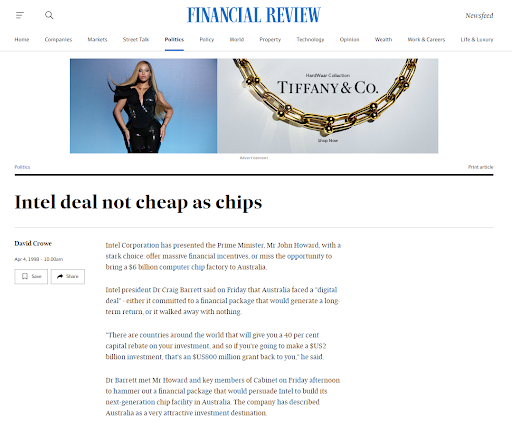

However, non-Australian semiconductor companies have not been willing to make the huge investments required to establish advanced manufacturing facilities in Australia, despite several approaches over the past four decades. (For example, a site selection team from Intel visited Victoria in the early 2000s to assess the attractiveness of locating a facility there.)

Barriers to such investment include the lack of a large domestic market for semiconductor components, the relative remoteness from major markets, the lack of skilled labour and the lack of an intact ecosystem to support maintenance and supply of a fab. This calculus could change as Australia’s domestic industry grows and its workforce develops, giving these non-Australian companies a more compelling reason to make large investments in Australia.

Alternatively, with recent geopolitical and semiconductor supply chain developments as discussed in Part 2, a non-Australian company might wish to strengthen its supply chain by securing particular resources, such as critical materials or novel materials platforms, which it could only obtain in Australia. In such a case, Australia could leverage the interest of this non-Australian company (or country) into an expanded physical presence, which might include supporting local fabrication.

Figure 3 Story headlines from the Australian Financial Review, 4 April 1998; Source: Intel deal not cheap as chips (afr.com)

Australia’s historical experience is consistent with analysis conducted by BCG in 2020, which identified the most important factors applied by semiconductor companies in deciding where to base operations (by rank, high to low):

1. Synergies with their existing ecosystem and footprint

=2. Labor costs

=2. Access to talent

4. Government incentives

5. Security of IP / assets

6. Capital expenditure

=7. Supporting infrastructure

=7. Ease of doing business

9. Geopolitical considerations

The weight given to each factor will vary on a case-by-case basis. However, the first factor (leveraging what you already have by expanding an existing local footprint) bypasses many start-up issues and costs, is clearly a sensible strategy and drives many decisions. Hence, for example, both Intel and Infineon have recently committed expansion funding to their Malaysian-based semiconductor operations (US$6.33 billion and US$1.7 billion respectively).

How did Malaysia start this cycle? Developing talent pools and pipelines that are productive for their wage levels, are professional and trustworthy are important parts of the country’s offering. No doubt all the other factors identified by BCG also played a role.

This is now a global contest. There are definitely ‘great power’ dimensions. In many respects not having some important role, or strategic asset, within the semiconductor value chain puts a country at a decided disadvantage.

4.2) Growing existing Australian semiconductor companies

As shown in Figure 1, Australian-based semiconductor companies cover a broad range of business models and technologies. However, few Australian-owned and controlled companies have established significant roles in the global semiconductor industry, and few have successfully brought products to market in a sustained and profitable way. Accessing growth capital, markets, and talent across the spectrum of capabilities required in a timely manner are ongoing challenges for Australian semiconductor companies.

Figure 4 Sydney-based, and ASX-listed, Bluglass has recently acquired a California laser diode fabrication facility to increase their capacity, capability and control. Source: SILICON VALLEY FAB NOW CONTRIBUTING TO TECH ROADMAPS | Bluglass

4.3) Establishing and growing new semiconductor companies

We will not attempt a comprehensive guide to establishing and growing semiconductor companies here. However, we offer a few considerations and practicalities in the following sub-sections.

4.3.1) Business models

Looking across the industry, we see seven primary ways that semiconductor companies generate revenue (i.e., seven business models).

- Sell services: Foundries, such as IQE (a British epitaxy development and fabrication company), TSMC (chip fabrication) and ASE (assembly), sell manufacturing services. Many smaller companies sell design and product development services.

- Sell components: Chip companies develop and sell semiconductor components. Integrated device manufacturers, such as Samsung, Intel and Texas Instruments, manufacture their own parts. Alternatively, fab-less design companies, such as Nvidia, Xilinx and Broadcom, fully outsource manufacturing. In between are companies that outsource portions of the manufacturing process and perform the other portions internally.

- Sell systems incorporating components: System manufacturers, such as Apple, will frequently design semiconductor components for incorporation into their own products, which include desktop and laptop computers, phones and tablets in the case of Apple.

- License (or sell) technology: Companies such as ARM and Qualcomm license intellectual property cores for incorporation in products of other companies.

- License (or sell) EDA tools: Companies such as Mentor Graphics, Synopsys and Cadence develop and license or sell the software tools used to design chips.

- Sell materials and subsystems: Companies such as Air Liquide, Shin-Etsu and Dow Advanced energy manufacture and sell the materials and manufacturing subsystems used in chip manufacturing.

- Sell equipment: Companies such as ASML, Applied Materials, TEL and Veeco manufacture and sell the equipment used in the fabrication of semiconductor components.

Addressing the strategic and economic imperatives discussed in Section 2 requires establishment and growth of companies that sell semiconductor components, the second business model, and that is our focus in this series of articles. However, we see opportunities for Australia in the other business models, as well. For example,

- Growing expertise in compound semiconductor epitaxy in Australian universities and industry (BluGlass, Silanna) suggests opportunities in epitaxy equipment and design tools,

- Large natural deposits of critical materials, such as silica, suggest opportunities in onshore processing of semiconductor materials, and

- Widespread expertise in materials analysis and engineering suggests opportunities in analytical tools to support semiconductor materials development.

Finally, many additional companies and organisations support semiconductor companies, creating additional business models. For example,

- IMEC in Belgium and A*Star in Singapore conduct research on behalf and in close collaboration with industry participants,

- Universities provide staff and valuable intellectual property, and

- Many companies provide equipment and facilities maintenance, legal, financial and other services.

Notably, Australia-based Macquarie Bank is one of the world’s leaders in semiconductor fab brokerage and semiconductor manufacturing equipment financing.

4.3.2) Product leadership

For the most part, semiconductor components are sold to other businesses, rather than directly to consumers, such as ‘hobbyists’ assembling electronic systems at home. The processes used by business customers to decide on the semiconductor components they will adopt can be complex, taking many factors into consideration, including:

- Cost: the unit cost of the product in small and large volumes;

- Performance: measured by key performance parameters, such as access times for solid-state memories, output power intensity for light-emitting diodes and performance benchmarks for microprocessors;

- Fit: the overall fitness of the product for its intended purpose, meaning how well it satisfies all reliability, electrical, mechanical, thermal, optical and other requirements;

- Delivery capability: the ability of the supplier to deliver the product in the required volumes at the required times and quality levels; and,

- Business viability: the long-term viability of the supplier’s business.

Softer factors can dominate the decision-making process, especially for larger customers, who typically prefer to purchase from established (trusted) suppliers and to work with a smaller number of suppliers, preferring to purchase multiple components from a single supplier rather than single components from multiple suppliers.

These softer factors create significant barriers to entry for early-stage companies, often forcing them to engage intermediaries (e.g. those who “white-label” their parts) or focus on smaller customers first.

Although cost can be an important factor in the decision-making process, in our experience, early-stage companies can rarely achieve a sustainable cost advantage and, instead, should focus on achieving “product leadership” – leadership in the most important performance-related parameters of their product. (Obviously, “leadership” depends on the product and requires an understanding of prospective customers, their products and what they hope to achieve with their products.)

Early-stage semiconductor companies can achieve product leadership through innovation in design, innovation in technology or both. Leadership can be achieved by developing a completely new product, typically for a new market segment, or by developing a better product for an established market segment. Clearly, the greater the leadership, the greater the opportunity for any given market segment.

Regardless, new companies introducing new products will need to overcome the soft factors mentioned above and will be competing against “good enough”, meaning their prospective customers might not value their performance advantage sufficiently to take a risk on a small, unknown and unproven company. Commercialisation skills, including marketing and positioning, are crucial in this execution phase.

The soft factors can work in favour of an early-stage company when the company can offer a strategic advantage. For example, Australian Defence might favour an early-stage Australian supplier over foreign suppliers if the Australian company’s components are “good-enough” for the intended applications.

4.3.3) Windows of opportunity

Product leadership has little value if the product is not ready when it is required or cannot be produced in the required volumes at the required times.

Semiconductor products face well-recognised “windows of opportunity” in which prospective customers are prepared to evaluate and adopt new products. Missing such a window can cause a product to miss revenue targets or fail entirely. Consequently, “time to market” (the time from product conception to market introduction) and “time to money” (the time to volume production) have been important drivers in the semiconductor industry and, in particular, have driven developments in design automation.

Examples abound of semiconductor products that have failed because they were late to market. A classic example is IBM’s first personal computer for which IBM chose Intel’s 8088 microprocessor over Motorola’s 68000, which was considered the better product, because the 68000 was not ready for production when it was needed.

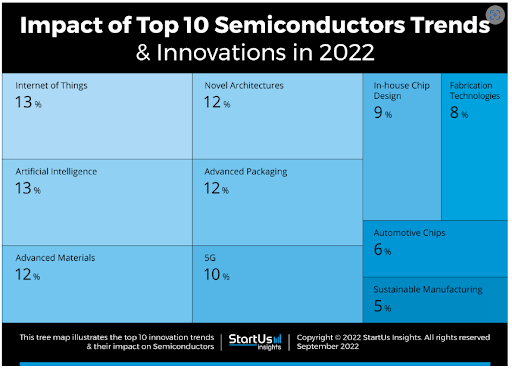

The success of an early-stage semiconductor company, possibly facing a multiple-year development cycle, requires the company to anticipate market conditions at the time their product will be ready for production.

Figure 5 Anticipating trends and timing is what Semiconductor Investors (Venture Capitalists) seek to do in conjunction with their startup founders. Source: StartUs Insights (Top 10 Semiconductors Trends & Innovations in 2022 | StartUs Insights)

Figure 5 Anticipating trends and timing is what Semiconductor Investors (Venture Capitalists) seek to do in conjunction with their startup founders. Source: StartUs Insights (Top 10 Semiconductors Trends & Innovations in 2022 | StartUs Insights)

4.3.4) Challenges in offshore semiconductor manufacturing

Early-stage companies face significant challenges in accessing off-shore manufacturing capacity, especially when foundries are running close to full capacity. In general, foundries:

- Will allocate capacity preferentially to large, established customers,

- Prefer customers who will use their standard processes and equipment,

- Prefer customers who do not want to introduce non-standard materials, and

- Prefer customers who will ramp quickly into high-volume manufacturing (1,000s of wafers per month) and do not require lengthy periods of research and development.

Accordingly, foundries favour fab-less design companies addressing large market segments with products that can be manufactured using their standard processes and equipment. Any requirement to introduce new materials, new equipment or new processes will reduce the likelihood of successfully engaging a foundry. Similarly, companies requiring long R&D phases or who cannot provide clear evidence of large demand for their products will find it difficult to secure support from foundries.

Furthermore, offshore manufacturing can significantly increase manufacturing cycle times. More important than the transit time in shipping wafers to and from a foundry can be the delays in waiting for the foundry to process wafers. For example, with recent heavy loading of contract assembly facilities, wait times blew out to weeks or months to process assembly jobs that required less than a day of processing time. Small jobs, ones that require engineering resources or ones from a low-priority (i.e., small) customer will often face long delays at foundries.

Such delays can be devastating, especially for early-stage companies, resulting in lengthy development and qualification times, often causing windows of opportunity to be missed, and limiting the number of manufacturing cycles that can be completed within a practical amount of time.

Regardless, the barriers to engaging foundries will be much lower for fab-less design companies using standard processes, equipment and materials at commercial foundries. Such standardisation enables companies to participate in multi-project wafers (MPWs) brokered by organisations such as MOSIS (https://themosisservice.com/) and Europractice (https://europractice-ic.com/).

When customisation is required, local staff, ideally hired locally, can help lower the barriers to entry at foundries. In particular, local staff with established networks can build on their relationships with engineers at the foundries to secure capacity to support R&D runs. We have found this to be a particularly successful strategy in engaging assembly service providers in Taiwan.

4.3.5) Challenges in onshore semiconductor manufacturing in Australia

Many of the issues associated with developing products based on non-standard processes could be resolved with onshore manufacturing capability dedicated to supporting domestic semiconductor companies through the early stages of product development, qualification and prototype manufacturing. ANFF (https://www.anff.org.au/) plays a vital role in supporting research and development of new semiconductor technologies. Missing in Australia is a facility that can support companies through the ensuing stages.

We discuss the challenges associated with onshore semiconductor manufacturing in Part 4. Some of the challenges mirror the barriers to investment by non-Australian companies, notably the lack of an established ecosystem to support semiconductor manufacturing in Australia. Others, such as relatively high operating and capital costs, will diminish as semiconductor manufacturing increases in Australia. Perhaps the most difficult challenge is the lack of semiconductor manufacturing know-how (expertise) in Australia. As discussed in Part 4, such know-how is typically developed through experience and is hard to acquire otherwise.

5) Conclusion

Earlier parts of this series have explored the changing global market for semiconductors, the increased recognition of the importance of semiconductors for economic and national security, newly emerging opportunities and changing industry dynamics.

We see growing appreciation of the strategic importance of semiconductors in Australia and a growing willingness to address the challenges and opportunities in a coordinated fashion.

A great state-based example of this is the Semiconductor Sector Service Bureau (S3B*) in NSW. S3B promises to grow the semiconductor sector in Australia by providing market intelligence, facilitating foundry access, promoting access to training, and fostering collaboration in the semiconductor sector. We strongly endorse this initiative and hope that it can expand (or be replicated) nationally, as the sector requires unified Australia-wide coordination and support.

One of the primary charters of S3B is to help such companies navigate the challenges associated with engaging foundries for fabrication services. We strongly recommend that Australian semiconductor companies make S3B their first point of contact when seeking foundry services ([email protected]).

Security and economic imperatives make it essential for Australia to increase its participation in the semiconductor industry, in general, and in the design and manufacture of semiconductor components. Australia cannot achieve self-sufficiency in semiconductors and will need to choose the sectors in which to focus. Australia faces significant challenges in developing its domestic semiconductor industry. However, we see a path forward, as will be discussed in Part 4 of this series.

Main picture: credit Bluglass

* In the interest of transparency, both authors are affiliated with the S3B. Glenn Downey was a proposer and developer of the NSW Government funding business case that led to the establishment of the S3B. Steven Duvall is a member of the Board of the S3B.

Dr. Steven Duvall has been in the semiconductor industry for nearly 40 years since completing his PhD at Stanford University in 1983. He spent 18 years with Intel in California driving corporate initiatives in design for manufacturability and six years with Intel in Australia supporting Intel Capital globally with technical and commercial due diligence of entrepreneurial companies. He spent 14 years with Silanna Semiconductor, an Australian developer and manufacturer of advanced semiconductor components, where he was the Chief Technology and General Manager of Ultraviolet Products.

Glenn Downey is Executive Director of The Maltby Group. Glenn was the primary author of the NSW Office of the Chief Scientist and Engineer’s ‘Australian Semiconductor Sector Report (2020). Glenn co-founded and led Sydney based OFDM cable modem technology developer Aurora Communications Limited through till its acquisition by ADC Telecommunications, led the investment and commercialisation activities for Redfern Photonics, the commercialising vehicle for the Australian Photonics CRC, and was Commercialisation Director at NICTA prior to its merger with CSIRO.

@AuManufacturing![]() and AUS-Semiconductor-Community’s editorial series, Australia’s place in the semiconductor world, is brought to you with the support of ANFF.

and AUS-Semiconductor-Community’s editorial series, Australia’s place in the semiconductor world, is brought to you with the support of ANFF.

@aumanufacturing Sections

Analysis and Commentary Awards Defence Manufacturing News Podcast Technology Videos