EOS to raise $40 million to prepare for increased demand

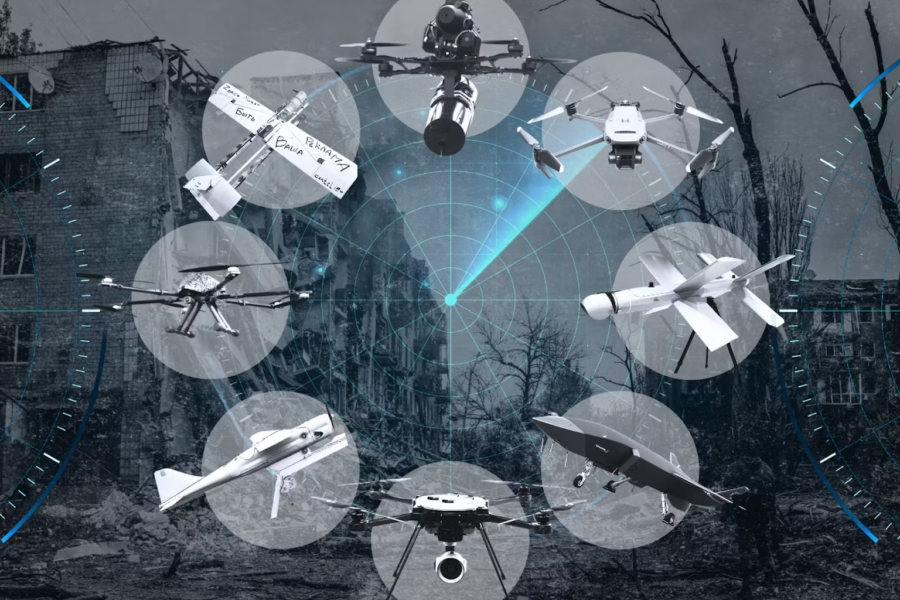

Communications and defence contractor Electro Optic Systems is to raise $35 million to cater for growth including purchasing long lead time items such as cannon for its in-demand remote weapons systems (RWS, pictured).

There has been a surge of recent orders for its large and especially small RWS systems – these enable missiles, cannon and machine guns to be launched from inside the safety of an armoured vehicle.

Its smallest system is also being sent to Ukraine in numbers to counter drone attack – the system's high accuracy even when fired from a moving vehicle such as a standard utility vehicle is seen as an advantage.

The Canberra company will raise $35 million in a fully underwritten placement and a further $5 million from existing shareholders ‘to capitalise on near-term growth opportunities'.

The raisings are priced at $1.70 a share, an 18.3 percent discount on the recent average price of shares on the ASX of $2.08.

However at this price EOS has also taken advantage of a recent surge in its share price which has doubled in only a few months from around $1.

Raising cash now enables EOS to raise cash at a higher price, without shareholders becoming disillusioned with the businesses' prospects.

EOS Managing Director and Chief Executive Officer Dr Andreas Schwer said: “The equity raising enables EOS to better capitalise on near-term growth opportunities by investing in long lead time items particularly cannons.

“EOS has significant near term opportunities in RWS and particularly those with counter-drone applications, driven by geopolitical uncertainty and the changing nature of warfare.

“EOS customer base has widened and this equity raising will support servicing market demand for EOS' innovative products.”

Further reading:

Electro Optic Systems $120 million in supply agreement with Ukraine

Browse @AuManufacturing's coverage of Electro Optic Systems here.

Picture: Electro Optic Systems

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos