Some SME-centric solutions for lagging technology adoption

As this publication has noted before, one of the defining features of manufacturing in this nation is the large number of small companies.

And while we regularly note the SMEs' entrepreneurial streak and contributions to progress, being of a certain size comes with its limitations.

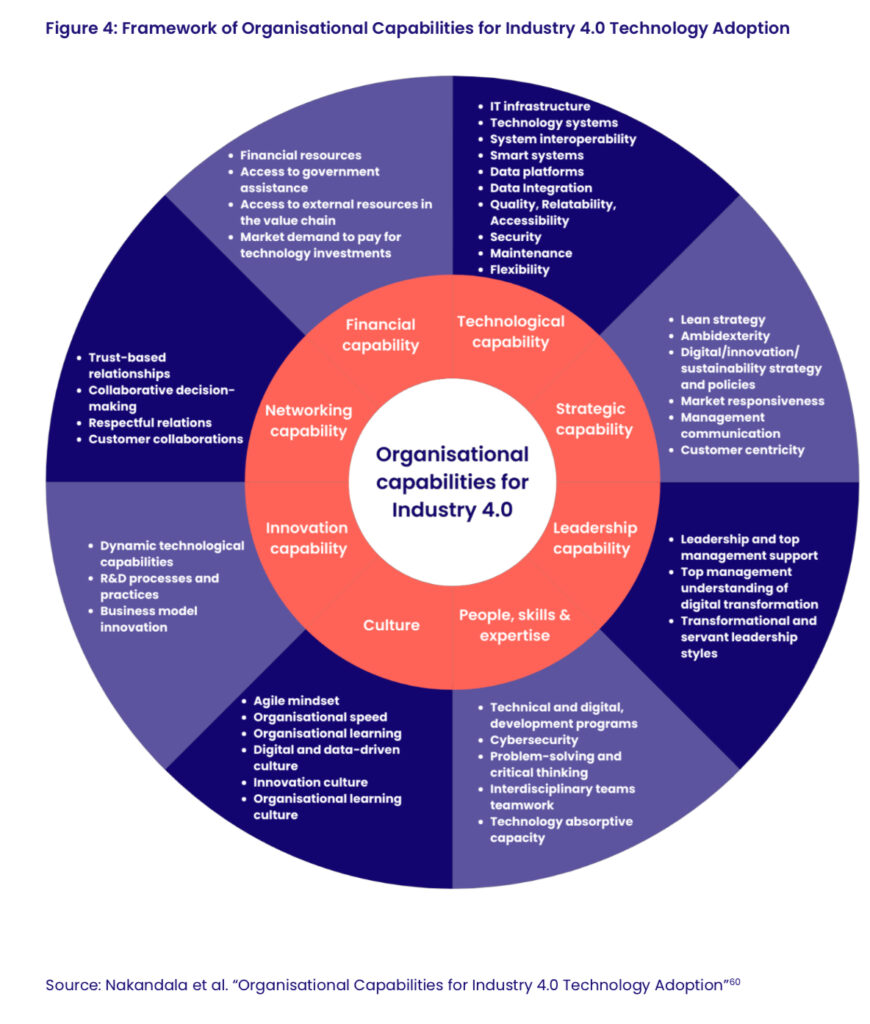

SMEs spend 24 per cent more on R&D than large companies, and such manufacturers are among the most likely to innovate, notes researcher Dilupa Nakandala in a recent paper. They also lag in adopting new technologies, and suffer a big list of hurdles to remedying this and therefore shoring up their resilience.

“There are a series of barriers, but it is important to note that the impact of these different barriers can vary depending on the companies and also the types of technologies considered for adoption,” Nakandala, an Associate Professor of Management at Western Sydney University’s School of Business, tells @AuManufacturing.

The seemingly self-perpetuating set of obstacles to Industry 4.0 includes the diversity in things like ownership and organisational structures “as well as low standardisation in SME operations, processes, and technologies” writes Nakandala in the policy paper, Recharging SME manufacturing in NSW.

Faithfully meeting their needs — which are far from one size fits all — can therefore be an integration challenge for a vendor. On the other side, the solution-shopping SME’s size presents disadvantages “in bargaining… and in their ability to invest”.

Nakandala’s paper for the James Martin Institute, where she is a Policy Fellow, looks at the thorny problem, how other countries are approaching it, and a set of possible policy responses. It is based on a literature review and emerging research.

Republished from Recharging SME manufacturing in NSW

It is also told from from a NSW perspective, where 93 per cent of manufacturers are small (under 20 employees), 6.4 per cent medium (up to 199) and fewer than a per cent are classed as large.

Its four recommendations include a “NSW-SME-Centric Manufacturing Technology Centre”, a technology advisory program (informed by the UK’s Liverpool City Region 4.0 initiative), an industry secondment program placing experts from larger firms within smaller manufacturers, and a technology leasing program.

“The lack of confidence and readiness of SMEs to adopt advanced technologies are partly linked to their lack of skills, experience, and the lack of dedicated in-house personnel. And also the lack of access to external expertise,” says Nakandala of the secondment proposal.

“There are benefits for the large companies [participating] that are technologically more developed, and also to the technology experts. For example, large companies can develop deeper insights into their supply chain operations if they introduce a secondment program with SMEs in their own supply chain.”

In this episode of @AuManufacturing Conversations, we hear from Nakandala about her research and her new policy paper, Recharging SME manufacturing in NSW: Opportunities for government to boost adoption of Industry 4.0 technologies.

Episode guide

0:38 – Background. Studied as an electrical/electronic engineer, worked in various roles at IBM World Trade Corporation (the first female engineer at the company) before moving into academia in 2007.

2:22 – Why SME manufacturers became a research focus.

4:24 – The policy insights paper on challenges faced by manufacturing SMEs in technology adoption released by the James Martin Institute, where Nakandala is the inaugural Policy Fellow.

5:31 – Barriers to adoption are multidimensional. Here are a few of them.

7:30 – Data collected from SMEs through several studies, including on resilience benefits – both operational and supply chain resilience – from adopting advanced technologies.

9:44 – Two policy proposals from the paper to help companies get exposed to, learn about, and benefit from new technologies. Firstly, an industry secondment program placing experts from larger enterprises in smaller companies.

11:47 – Secondly, a technology leasing program for smaller companies.

13:03 – International examples of what good looks like.

14:59 – Some thoughts on jargon and buzzwords from vendors.

16:45 – Industry 4, Industry 5, Industry 6…

17:58 – There’s work to be done to change the industry’s image. Attracting tech-savvy youngsters depends on it.

@aumanufacturing Sections

Analysis and Commentary Awards casino reviews Defence Gambling Manufacturing News Online Casino Podcast Technology Videos